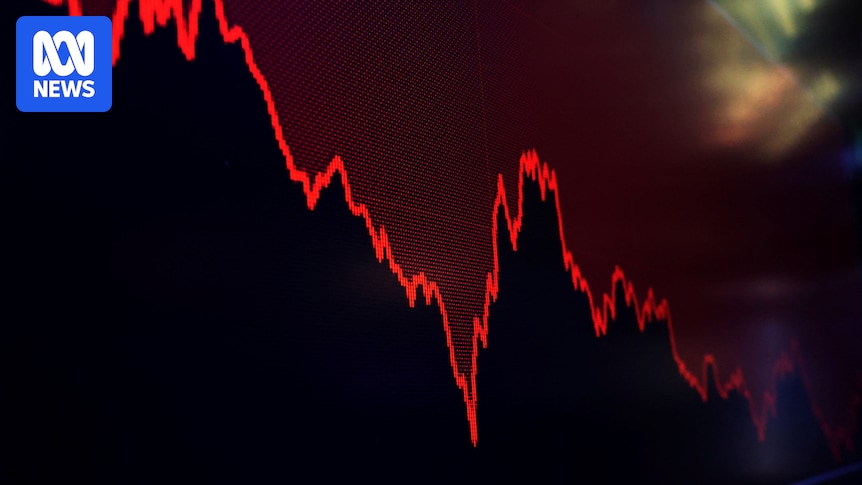

Global financial markets experienced a significant downturn as U.S. President Donald Trump’s controversial remarks regarding Greenland sent shockwaves through Wall Street and the U.S. dollar. The “sell America” trade gained momentum, leading to a notable sell-off in U.S. assets, including stocks and bonds.

The immediate impact was felt across major indices. The Dow Jones Industrial Average fell by 1.8%, the S&P 500 dropped 2.1%, and the Nasdaq Composite declined by 2.4%. This marked the worst single-day performance for the S&P 500 in three months, erasing gains accumulated over the past month.

Global Market Reactions

European markets mirrored the U.S. downturn, with the FTSE 100 and Germany’s DAX both declining by 0.7% and 1%, respectively. The Stoxx 600 index also fell by 0.7%. Meanwhile, the Australian share market opened with a 0.3% drop, influenced by Wall Street’s overnight performance.

In commodities, gold surged to a record high of over $4,700 per ounce, driven by heightened demand for safe-haven assets amidst geopolitical uncertainties. Spot gold rose by 2% to $4,762 per ounce, while Brent crude oil saw a modest increase of 0.1% to $64 per barrel.

Safe-Haven Assets in Demand

Gold miners emerged as the best performers on the ASX, with companies like Westgold and Evolution Mining seeing their shares rise between 3% and 8% in early trading. This surge was fueled by the escalating geopolitical tensions and the weakening U.S. dollar.

According to market analyst Fawad Razaqzada, “Gold has surged deeper into uncharted territory as investors hedge against rising political risk. A softer dollar is providing an additional tailwind for precious metals, reinforcing gold’s rally at a time when confidence in U.S. assets appears to be wobbling.”

U.S. Dollar and Bond Market Turmoil

The U.S. dollar index fell by 0.8% overnight, contributing to the Australian dollar’s rise to 67.3 U.S. cents, its highest level in over a year. This decline in the greenback has been attributed to President Trump’s erratic trade policies and the burgeoning U.S. government debt.

In the bond market, the yield on U.S. 10-year Treasury bonds rose to 4.3%, reflecting increased investor demand for higher returns amid the sell-off. This was compounded by a significant sell-off in Japan’s bond market, which saw borrowing costs hit record highs.

“If there is a strong mandate following the election, that could open the door to more fiscal spending,” said Seema Shah, chief global strategist at Principal Asset Management. “It pulls a lot of global bond markets into a difficult story about debt and you can see that in the rise in borrowing costs.”

Implications and Future Outlook

The current market turbulence highlights the fragile state of global economic relations, exacerbated by President Trump’s aggressive stance on trade and territorial ambitions. The imposition of additional tariffs on European imports is set to further strain U.S.-Europe relations.

Canadian Prime Minister Mark Carney, speaking at the World Economic Forum in Davos, emphasized the need for middle powers to collaborate in response to the shifting geopolitical landscape. He warned, “In a world of great power rivalry, the countries in between have a choice – compete with each other for favour, or to combine to create a third path with impact.”

Looking ahead, investors will be closely monitoring the U.S. Federal Reserve’s policy decisions, particularly regarding interest rate cuts, which could influence the trajectory of the U.S. dollar and global markets. The potential for further geopolitical tensions and economic disruptions remains a critical factor for market stability.

As the situation unfolds, market participants are advised to remain vigilant and consider diversifying their portfolios to mitigate risks associated with the ongoing uncertainties.