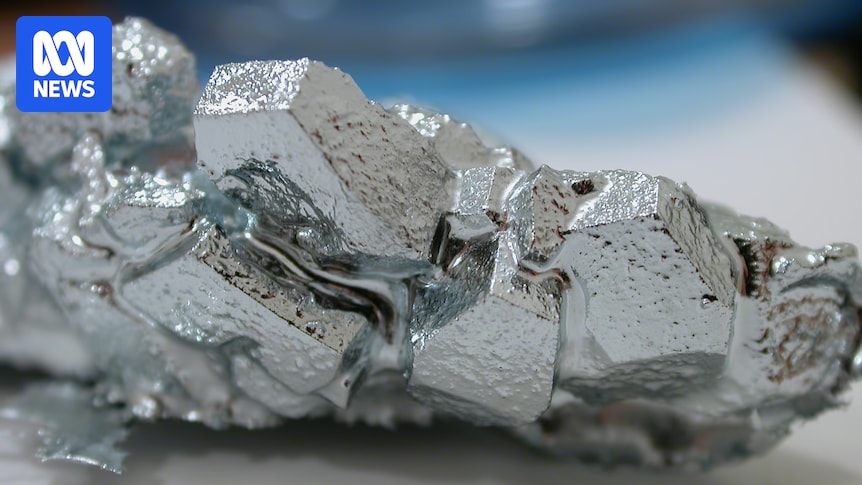

Australia’s critical minerals industry has broadly welcomed a significant rare earths agreement between the United States and Australia, a move analysts believe will bolster the rare earths supply chain beyond China’s influence. The two nations have committed to investing at least $US1 billion each over the next six months, unlocking an $US8.5 billion pipeline of critical mineral projects aimed at reducing global reliance on China.

The Minerals Council of Australia lauded the US-Australia Critical Minerals Framework, which is expected to attract more investment into Australian mining and processing sectors. “This is an acknowledgement of Australia’s strategically important role in the development of new technologies, defence capabilities, and renewable energy infrastructure,” said CEO Tania Constable. She emphasized Australia’s readiness to meet the increasing demands of its long-standing partners in Asia, the US, and Europe.

Market Reactions and Investment Details

The announcement comes as critical minerals stocks experienced a surge on the Australian share market. Companies like Alcoa and Arafura Rare Earths, earmarked for further investment, saw significant early gains. Alcoa Corp’s shares jumped 7.49% to $59.68, while Lynas Rare Earths fell by 7.56% to $18.96 by the close of trade on Tuesday. Other companies such as South32, Pilbara Minerals, BHP, and Mineral Resources also contributed to the ASX200 Materials sector reaching a record high.

According to the deal, two key projects have been prioritized: the Alcoa-Sojitz project in Western Australia and Arafura’s Nolan project in the Northern Territory. The Alcoa-Sojitz joint venture will receive up to $US200 million from the Australian government, with additional funding from the US. Japan will support the Sojitz Corporation’s portion, aiming to supply up to 10% of the world’s gallium, crucial for semiconductors and advanced defence technologies.

Strategic Importance and Global Implications

Gallium production, currently dominated by China, has become a focal point for establishing alternative supply chains. UBS analysts expressed optimism over the involvement of other countries, including Japan, in the investment projects. Alcoa’s CEO, William Oplinger, welcomed the opportunity to contribute to a new gallium source, highlighting the strategic importance of Alcoa’s Australian operations.

Arafura Rare Earths announced it received conditional approval for an equity investment of up to $US100 million from the Australian government, with the US considering up to $US300 million in financial support. The project is expected to produce 5% of global rare earths once operational.

Processing Over Mining: A Shift in Focus

Beyond mining, the deal emphasizes processing capabilities. Several Australian companies have received Letters of Interest from the Export-Import Bank of the United States, totaling over $US2.2 billion. These include Arafura Rare Earths, Northern Minerals, and others. Adam Handley, chair of Northern Minerals, described the deal as a critical step in developing Australia’s rare earths supply chain and supporting the western world’s efforts to establish independent critical mineral supplies.

Northern Minerals plans to semi-process dysprosium and terbium, shipping the concentrate to Iluka Resources for further processing. Iluka is constructing Australia’s first fully integrated rare earths refinery, capable of producing both light and heavy rare earth oxides.

Challenges and Future Prospects

Despite the substantial investments, experts warn of the need for further market development. Lian Sinclair, an economic geographer at the University of Sydney, stressed the importance of investing across the supply chain, including refineries and magnet production in allied countries, to reduce dependency on China’s industry.

“Without investment in refineries and magnet production in allied countries, Australian miners will continue to either sell into or be outcompeted by Chinese domestic industry,” Dr Sinclair stated.

At the White House, the US president hinted at a potential influx of critical minerals, suggesting that within a year, there would be an abundance of rare earths. However, UBS analysts cautioned that such timelines are overly optimistic, noting that typical project timelines suggest a longer duration.

Dr Sinclair also criticized the Australian government for insufficient planning regarding the environmental, social, and cultural impacts of domestic rare earth production. As the industry moves forward, balancing economic growth with sustainable practices remains a critical challenge.

The US-Australia rare earths deal represents a significant step towards diversifying global supply chains and reducing dependency on China. However, the path ahead requires careful navigation of market dynamics, environmental considerations, and geopolitical interests.