Donald Trump is banking on Venezuela’s vast oil reserves to justify potential U.S. intervention, but the realities of the industry, global energy trends, and basic economics suggest this strategy may be flawed. The former president’s belief in the value of Venezuelan oil reserves could undermine any success of U.S. involvement in the region.

In a Truth Social post dated January 7, Trump announced that “the Interim Authorities in Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America.” He claimed that the proceeds would be used for the benefit of both Venezuelans and Americans. However, experts argue that the situation is far more complex than Trump’s statements suggest.

The State of Venezuela’s Oil Industry

Venezuela holds the largest oil reserves in the world, yet its production has plummeted from 3.5 million barrels per day in 1999 to approximately 1.1 million barrels per day. This decline is attributed to corruption, U.S. sanctions, and state mismanagement. As a result, Venezuela has seen a dramatic economic downturn, losing three-quarters of its GDP over the last decade, prompting a mass exodus of its citizens.

Restoring Venezuela’s oil production capacity is fraught with challenges. The country’s pipelines, over 50 years old, suffer from severe damage due to acid corrosion. The national oil company, PDVSA, has been mismanaged and used as a financial resource by the government, leaving little for necessary maintenance and upgrades.

Investment and Administrative Challenges

Trump has acknowledged that U.S. oil companies would need to invest billions to revitalize Venezuela’s energy infrastructure. Yet, the logistics of such investments remain unclear, particularly regarding the financial burden on U.S. taxpayers. The Trump administration has yet to engage with oil companies about their willingness and conditions to re-enter the Venezuelan market.

A critical issue is the division of responsibilities between the U.S. and Venezuelan governments. Without U.S. military presence, the success of any intervention would heavily depend on the cooperation of the Venezuelan government. However, the administrative capacity of the new interim government, led by Delcy Rodriguez, remains uncertain. Many key figures from the Maduro regime, including those involved in the oil industry, retain their positions, raising doubts about potential reforms.

Economic Viability and Global Energy Trends

According to experts, including those cited in Britain’s Telegraph, it could take up to a decade to restore Venezuelan oil production to previous levels. Meanwhile, the global shift towards renewable energy is reducing the demand for crude oil. Venezuela’s oil, being heavy and bituminous, is costly to refine, further complicating its economic viability.

Chevron, the only American oil company still operating in Venezuela, reports production costs significantly higher than its global average. The company has announced plans to focus future investments in Guyana, where lighter oil is cheaper to produce.

With current global oil prices hovering around $60 a barrel, American companies may struggle to justify the costs of Venezuelan operations. By 2030, the demand and price for oil are expected to decline further, casting doubt on the long-term feasibility of investing in Venezuela’s oil sector.

Future Prospects and Political Implications

The future of Venezuela’s oil revenues is crucial for the country’s governance. However, Trump’s reliance on these revenues appears misguided given the current and projected economic realities. The potential lack of significant oil revenue could hinder the stability of any future Venezuelan government.

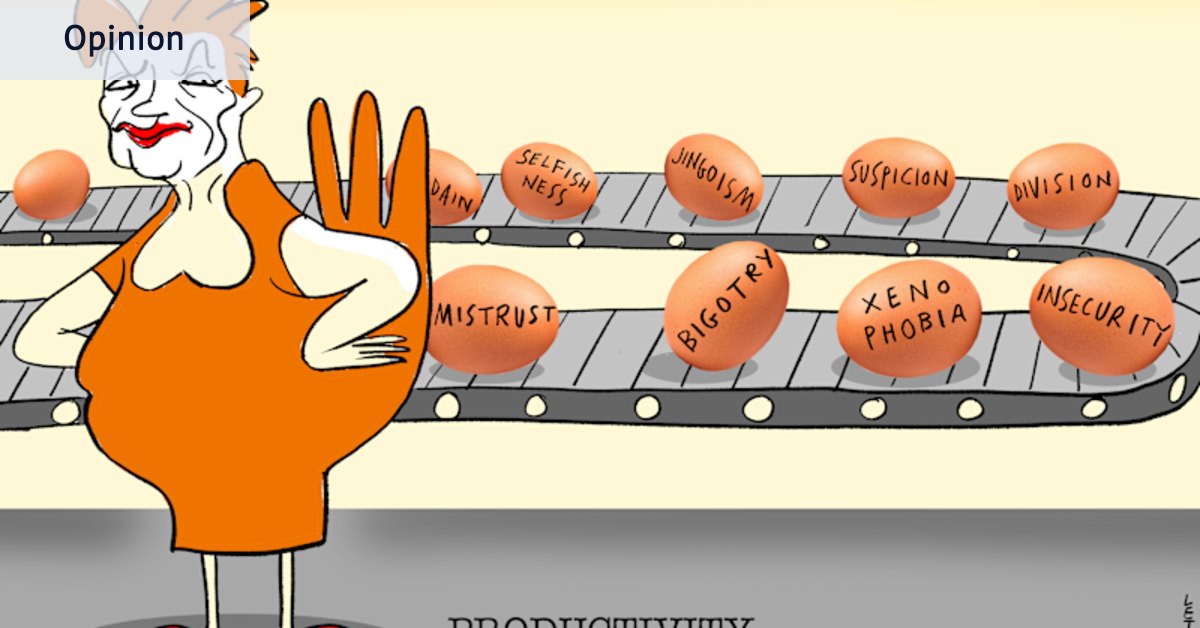

Trump’s approach to Venezuela reflects a broader pattern of overconfidence and disregard for complex realities. His strategy may ultimately prove detrimental, not only to U.S. interests but also to the prospects of a stable and prosperous Venezuela.

As the situation unfolds, the international community will be closely watching how the U.S. navigates its involvement in Venezuela and whether it can effectively address the myriad challenges facing the country’s oil industry.