Social media giants are facing increased pressure from Reserve Bank Governor Michele Bullock to intensify efforts in removing scams and financial spoofs from their platforms. Bullock highlighted the “scary” threats posed by rapid technological advancements to Australia’s advanced payment systems during a recent address in Sydney.

Her comments come as the Australian Competition and Consumer Commission (ACCC) raises alarms about access to cash in regional areas. Bullock underscored her concerns about the security of the payment network, emphasizing the dangers financial criminals pose.

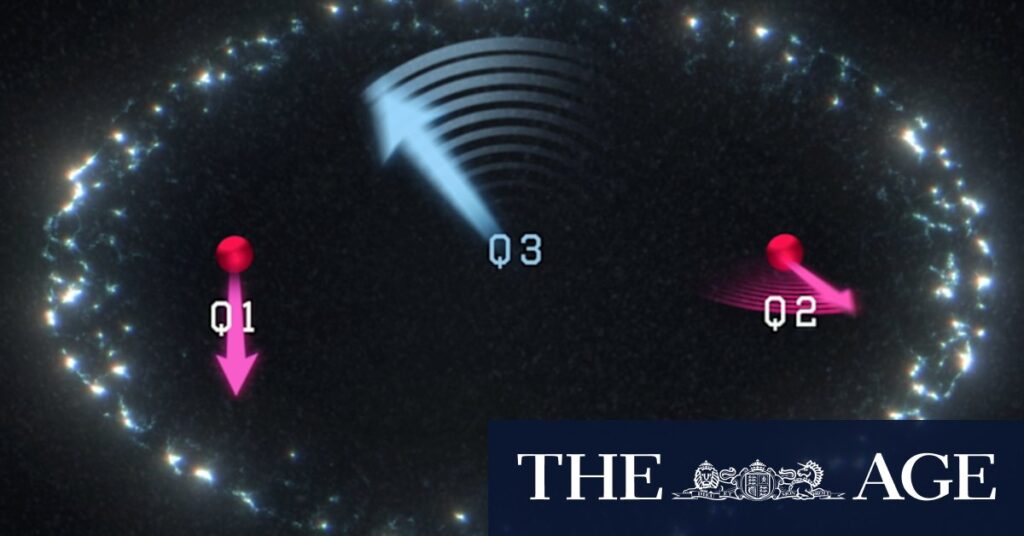

Quantum Computing: A Looming Threat

One of the most significant threats identified by Bullock is quantum computing. This emerging technology promises to solve complex problems much faster than current computers. Bullock warned that encryption systems, which currently take centuries to crack, could be breached in just minutes with quantum computing advancements.

“The fight against fraud and scams will no doubt require further innovation, adaptation, and cooperation by the payments industry – we can be certain that fraudsters won’t stand still in their efforts to steal people’s data and money,” she stated.

She further emphasized the need to protect card users against these technological advances, predicting that current encryption standards could be compromised in the future.

Personal Experiences and Broader Implications

Bullock shared a personal anecdote, revealing that her family narrowly avoided falling victim to a spoof scam. She expressed concerns that such attacks could become more prevalent as technology evolves.

Meanwhile, the Reserve Bank is anticipated to cut interest rates at least once more this year, following three reductions since February. These cuts have impacted the property market, with values increasing monthly since the bank began easing monetary policy.

Housing Market Dynamics

Speaking at the Bradfield Oration, Bullock noted that while interest rates influence the property market, the primary issue is the lack of new housing supply. She pointed out that a decrease in household size during the pandemic has exacerbated supply pressures, with many older Australians remaining in large family homes rather than downsizing.

“Many older people whose families have left home, who are still in their large homes, they’re not downsizing. So in terms of this issue of downsizing, I think there is a question about, are there policies, taxes, things we do that are discouraging people, perhaps, from downsizing from large homes?”

The Role of Social Media in Combating Scams

Bullock called on social media platforms, which have been criticized for hosting scam advertisements, to play a more active role in mitigating risks to consumers and businesses. “They have to be willing and ready to take down spoofs and scams,” she asserted, emphasizing the importance of collective engagement in encryption and security efforts.

Despite technological advancements in payment methods, cash remains a critical component of the payment system, especially during digital outages or natural disasters. Bullock noted that only 10 percent of transactions are currently conducted with cash, yet it remains an “essential part” of the system.

Ensuring Cash Availability

The decline in cash usage has strained the cash movement industry, prompting collaboration between major retailers and the Australian Banking Association (ABA) to ensure the continued circulation of banknotes across the country.

The Reserve Bank’s monetary policy committee is scheduled to meet on November 3-4, where further discussions on these pressing issues are expected to take place.