In a significant move that marks the largest layoff in Denmark’s history, Novo Nordisk, the maker of the popular weight loss medication Wegovy, announced on Wednesday that it will cut 9,000 jobs. This decision comes as the Danish pharmaceutical giant faces increasing competition from US rival Eli Lilly, which has been making strides in the same market.

The restructuring aims to save Novo Nordisk approximately 8 billion Danish crowns ($1.25 billion) annually. The announcement follows recent changes in the company’s leadership, with Maziar Mike Doustdar taking over as CEO from Lars Fruergaard Jorgensen last month.

Impact on Market Position and Investor Confidence

Once celebrated as Europe’s most valuable company by market capitalization, Novo Nordisk has seen a dramatic decline, with its market cap falling to around $181 billion from a peak of $650 billion last year. This decline is notable as it once surpassed Denmark’s entire annual gross domestic product.

On the day of the announcement, Novo Nordisk issued its third profit warning this year. Lukas Leu, a portfolio manager at ATG Healthcare and a shareholder in Novo Nordisk, told Reuters,

“They need to reignite investor confidence with an appealing growth story for the future. The obesity market was misjudged. It’s much more consumer-driven than anticipated, and Novo expanded organizational complexity too quickly.”

The Rise and Fall of Novo Nordisk

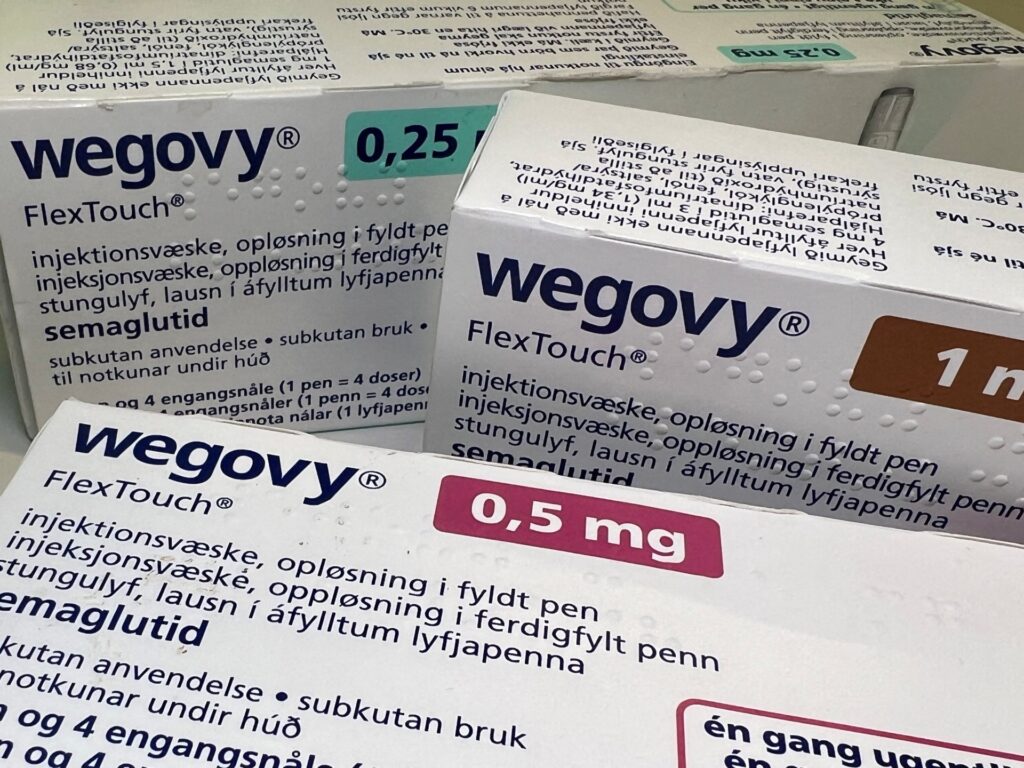

Novo Nordisk’s rapid growth began in 2021 when Wegovy became the first highly effective obesity drug approved in the United States. This led to nearly doubling its workforce over five years, propelling it to the top of Europe’s market capitalization rankings. However, the company has since been in a tug-of-war for that title with LVMH, the owner of Moet Hennessy and Louis Vuitton.

Based in Bagsvaerd, just outside Copenhagen, Novo Nordisk employs 78,400 people. The new job cuts will affect 11.5% of its workforce, with at least 5,000 positions being eliminated in Denmark alone. The company has not disclosed which specific business units will be impacted.

In July, Novo Nordisk experienced a $70 billion loss in market value as it warned of profit declines due to heightened competition in the market it once dominated. Analysts from Bank of America have suggested that Novo may issue a fourth profit warning when it reports its third-quarter results in November, casting doubt on its ability to meet its sales guidance targets.

Strategic Shifts and Future Plans

Despite the downsizing, Novo Nordisk is simultaneously working to boost production to meet rising demand for its products. The company is also preparing to launch a pill version of Wegovy and is exploring additional health benefits of its glucagon-like peptide-1 (GLP-1) portfolio.

In the fourth quarter, Novo expects to save at least one billion Danish crowns ($157 million), which it plans to reinvest into research and development, manufacturing expansion, and improving global patient access. CEO Doustdar emphasized the importance of strategic launches, stating,

“We need to have the best-in-class launches, especially as competition is increasing. We want to make sure we don’t have to spare a dime.”

Michael Novod, head of equity research for Denmark at Nordea Bank, commented on the restructuring,

“This is the new CEO’s first major move to simplify Novo’s structure and redirect resources toward growth in diabetes and obesity.”

Increased Competition and Market Dynamics

Novo Nordisk’s challenges have been compounded by slowing sales of Wegovy and its diabetes treatment medication, Ozempic, particularly in the US. Eli Lilly’s Zepbound overtook Wegovy in weekly prescriptions earlier this year, although Wegovy prescriptions have started to increase again, narrowing Lilly’s lead in this critical market.

The company’s stock has suffered due to the intensified competition, with shares dropping nearly 46% since the start of the year. However, on the day of the announcement, the stock saw a slight uptick, rising by 0.4% as of 11:45 am in New York (15:45 GMT).

As Novo Nordisk navigates these turbulent waters, the company’s future hinges on its ability to adapt to market demands and reinvigorate its growth strategy. The coming months will be crucial as it seeks to stabilize and regain its footing in the competitive pharmaceutical landscape.