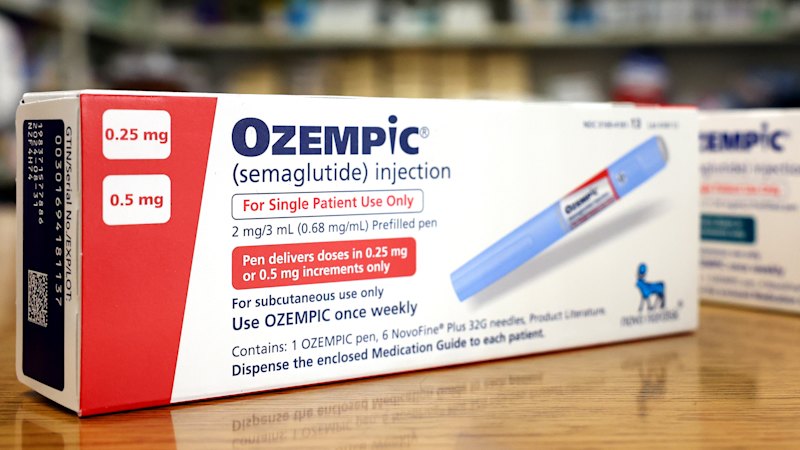

February 4, 2026 — Novo Nordisk, the Danish pharmaceutical giant known for its pioneering work in obesity treatments, is encountering significant challenges as competitors crowd the market with cheaper and potentially more effective drugs. The company, which created the widely used weight-loss drug Ozempic, is now witnessing a dramatic shift in its market position, particularly in Australia.

One of the key competitors, Eli Lilly, has confirmed that its weight-loss drug Mounjaro was Australia’s highest-selling prescription medication last year. This development has contributed to Novo Nordisk’s forecast of a 13 percent decline in sales this year, a revelation that sent its shares plummeting by 15 percent.

Market Dynamics and Competitive Pressures

The announcement comes as online weight loss clinics in Australia increasingly prescribe Mounjaro and anticipate the arrival of a next-generation drug, retatrutide. This new formula has generated such excitement that counterfeit versions are reportedly being imported from China.

According to a senior industry source, Eli Lilly currently leads in weight-loss efficacy, but Novo Nordisk offers superior drug delivery methods, including a pill form of Ozempic known as Wegovy, which boasts fewer side effects. “The interesting battle at the heart of the story is does weight loss matter or delivery,” the source remarked.

Financial Implications and Strategic Responses

Novo Nordisk, once Europe’s largest company by valuation with a market capitalization of $US400 billion in 2023, is now facing a significant reduction in its share price. The company’s chief executive, Mike Doustdar, acknowledged the competitive pressures but expressed optimism about the promising uptake of the Wegovy pill in the US market.

“In 2026, Novo Nordisk will face pricing headwinds in an increasingly competitive market. However, we are very encouraged by the promising early uptake from the US launch of Wegovy pill, and we remain confident in our ability to drive volume growth over the coming years,”

Doustdar stated.

Investor Lars Hytting of ArthaScope noted that the market’s reaction was more severe than even the most skeptical analysts had anticipated. Meanwhile, Novo Nordisk is preparing for further challenges, including steep discounts on Ozempic and Wegovy in 2027, as part of efforts to reduce pharmaceutical costs in the United States.

Innovation and Future Prospects

In Australia, competition remains a primary challenge for Novo Nordisk. The company has successfully launched the Wegovy pill in the US, but it is not yet available in Australia, where Eli Lilly’s Zepbound is gaining traction as a more effective weight-loss option.

Mounjaro, sold locally, is a dual agonist drug that activates two types of receptors for a stronger weight-loss effect than Novo’s offerings. Eli Lilly’s forthcoming retatrutide, a “triple G” hormone agonist, is expected to further disrupt the market by activating three receptors to enhance appetite suppression and fat metabolism.

Dr. Kieran Dang, chief medical officer at Mosh, commented, “The shift towards oral medications is also of interest. Many Australians have an aversion to needles, and options like an oral version of Wegovy or Eli Lilly’s orforglipron could make these treatments far more accessible and easier to stick with long-term.”

As Novo Nordisk works towards introducing the Wegovy pill in Australia, the company remains committed to advancing obesity treatment innovations. Tim Doyle, CEO of Eucalyptus, expressed excitement about the evolving landscape, stating, “The pipeline of transformative medications in this category is incredibly exciting. Both form factor and efficacy innovations are ultimately wins for patients with obesity.”

Eli Lilly, meanwhile, is seeking Australian registration for its next-generation obesity management medicine, orforglipron, with the Therapeutic Goods Administration recently accepting an application for registration.

The move represents a significant shift in the competitive dynamics of the obesity drug market, with implications for both companies and patients worldwide. As the landscape continues to evolve, the focus remains on balancing efficacy, accessibility, and innovation in the fight against obesity.