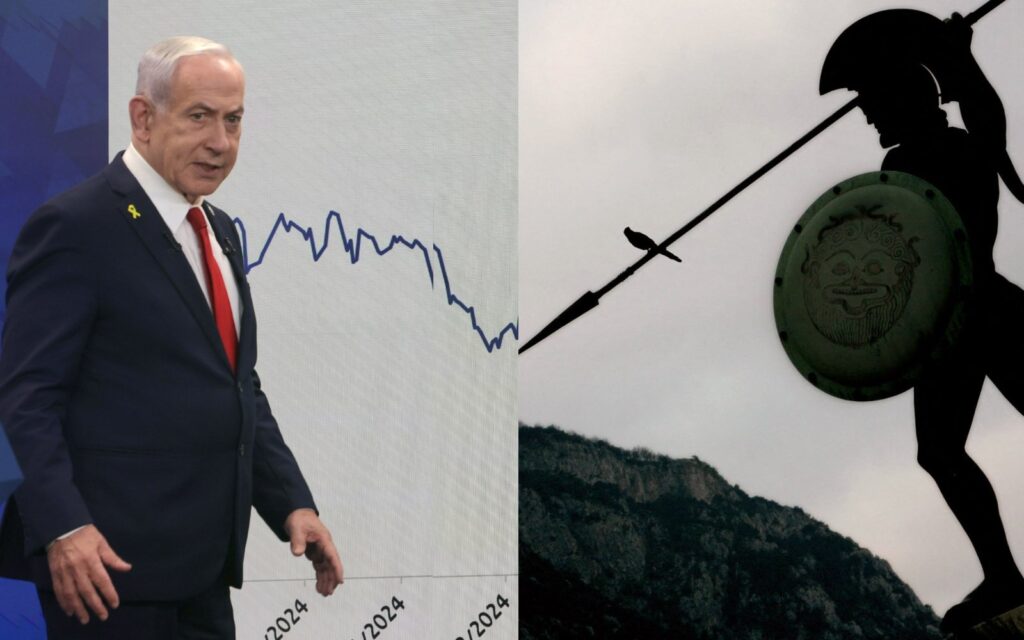

Just days before the Jewish New Year, Israeli Prime Minister Benjamin Netanyahu delivered a speech that has sent ripples through the country’s tech sector and financial markets. Netanyahu forecasted a future marked by economic and diplomatic isolation, suggesting that Israel must transform into a self-reliant economy with “autarkic characteristics” akin to a modern “super-Sparta.” This vision comes as the nation grapples with potential trade sanctions and boycotts, leaving investors and the tech community in a state of shock.

The announcement comes as European countries intensify pressure on Israel over its military actions in Gaza, threatening sanctions and downgrading trade ties. The European Commission recently warned of suspending parts of a trade agreement affecting approximately 5.8 billion euros ($6.78 billion) of Israeli exports to the European Union, Israel’s largest trading partner.

Immediate Backlash and Clarifications

Netanyahu’s comments quickly drew fierce criticism from business and tech leaders. In response, the Prime Minister clarified that his remarks were intended to focus on the defense industry and the need for security independence. However, this clarification did little to quell concerns about the broader economic implications.

“It’s an unacceptable vision. No one is buying that [super-Sparta vision], as it’s irrelevant for Israel,” stated Avi Hasson, CEO of Startup Nation Central. “Israel is not a superpower like China or the US — our economy as a whole relies on raw materials, and certainly for our tech economy, global connectivity is like our oxygen.”

Historical and Economic Context

In ancient Greece, Sparta was known for its self-imposed isolation to preserve its militaristic lifestyle. The term “spartan” often evokes a sense of austerity, a parallel that some fear could become a reality for Israel if Netanyahu’s vision were to materialize. While Israel has maintained a discreetly isolated stance since the outbreak of war post-October 7, 2023, public acknowledgment from the Prime Minister has heightened concerns.

Moran Chamsi, managing partner at Amplefields Investment Fund, expressed shock at Netanyahu’s speech, highlighting the challenges of the past two years. “It’s totally different when the prime minister says that out loud,” Chamsi noted.

Impact on the Tech Sector and Beyond

Beyond official embargoes and warnings, many Israeli companies operating internationally are already experiencing the effects of global anti-Israel sentiment. Avi Hasson cautioned against drawing conclusions from anecdotes but acknowledged their growing frequency.

“It’s hard to determine whether people decide not to do business with or invest in a company because of that extra risk that Israel entails, or whether it’s ideological, or whether it’s because employees or customers are not going to be happy,” Hasson remarked.

Netanyahu’s admission of increasing isolation prompted a panicked reaction from investors, causing a temporary dip in the Tel Aviv Stock Exchange. However, shares rebounded following a new U.S. proposal to end the conflict.

Resilience and Future Prospects

Despite ongoing conflicts and rising costs, Israel’s stock indexes have shown remarkable resilience. Over the past year, the TA-35 index of blue-chip companies surged by about 43%, while the TA-90 index rose by approximately 48%. Investors had been optimistic that Israel’s military successes against Iran’s nuclear program and its proxies would mitigate security and economic risks.

Much of the anticipated recovery hinges on Israel’s tech sector, a cornerstone of the economy. The sector contributes around 20% of local GDP, accounts for about 50% of total exports, and generates significant tax revenue. The Israeli tech industry is heavily reliant on foreign capital, with approximately 80% of venture capital investments originating from abroad.

“From the beginning of 2025, the tech industry, with many startup founders, entrepreneurs, and employees on and off on reserve duty in Gaza, has been working very hard to remain resilient,” Chamsi explained. “However, now some investors will likely decide to hold their investment process in Israel as they will want to wait out current developments.”

Challenges and Opportunities Ahead

Despite the challenges, investment in the Israeli tech market reached a three-year high in the first half of the year. In July, Palo Alto Networks acquired Israeli firm CyberArk for $25 billion, marking the largest acquisition of an Israeli company since Google’s $32 billion purchase of Wiz earlier this year.

“There are certain investors who are actually doubling down on Israel, so activity hasn’t stopped, but it is under the radar and very selective,” Hasson noted. “When investors map the world for innovation, Israel stands out.”

However, Hasson acknowledged that companies outside the cybersecurity and AI sectors face difficulties. “In Israel, that means hundreds, if not thousands, of companies that are suffering right now and are dependent on foreign capital,” he said.

Hasson expressed concerns that tech companies might relocate, impacting the local economy. “Israeli founders have proven that they will do whatever it takes for their company to be resilient and succeed — which could also mean shifting tasks or transferring capital outside of Israel,” he cautioned.

As Israel navigates these turbulent times, the separation between the tech sector and the nation poses significant challenges. The coming months will be crucial in determining whether the country can maintain its reputation as a hub of innovation and resilience.