Giant international ATM supplier NCR Atleos has announced the removal of over 50 machines from tobacco stores across Australia. This decision follows an investigation by ABC News that uncovered ATM companies’ involvement in facilitating illegal tobacco and vape sales. The New York Stock Exchange-listed company, known for having the world’s largest ATM network, has initiated a review of its fleet in light of these revelations, which highlighted how private ATM companies had made deals with local tobacco criminals.

The move by NCR Atleos means that, in total, more than 100 machines from various suppliers are being extracted from these locations. The company’s action specifically targets machines that allow tobacco store owners to load cash themselves—a feature that experts warn could potentially enable money laundering due to a regulatory blind spot.

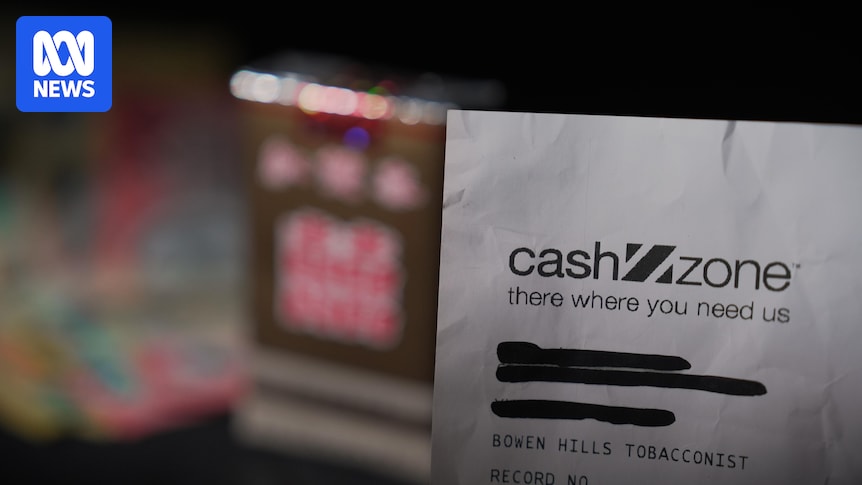

NCR’s Cashzone ATMs were discovered in stores selling illegal tobacco products. The company’s decision follows similar actions by other ATM suppliers, including Melbourne-based Next Payments, backed by Macquarie Group, and Queensland-based atm2go, which have also started removing their machines from stores linked to illicit tobacco sales. The ABC investigation revealed that these companies’ machines, along with NCR’s green Cashzone ATMs, were present in stores selling illicit tobacco and vapes in cities such as Brisbane, Darwin, and Sydney.

ATM Industry and Illicit Trade

One of the stores in Sydney with a Cashzone ATM was owned by an individual previously convicted on 15 counts of illicit tobacco sales. Another store in Brisbane was linked to a man with a past fraud conviction. Despite these findings, NCR declined to comment on the due diligence conducted before placing its Cashzone machines in these stores. However, a company spokesperson stated that following a review, “we have chosen to remove a number of ATMs and will be removing self-filled ATMs in tobacco stores, which account for 1 percent of our fleet.”

The spokesperson further emphasized that NCR, which operates over 5,300 ATMs across Australia, complies with “all applicable legislation.” The company’s proactive stance suggests a recognition of the risks associated with self-loading ATMs, particularly concerning the traceability of funds.

“Because cash is filled directly by store owners rather than through a regulated provider, such ATMs may present heightened vulnerabilities to misuse, including for money laundering or to facilitate proceeds of crime,” said Doron Goldbarsht, director of the Financial Integrity Hub at Macquarie University.

Goldbarsht noted that NCR’s decision to withdraw these ATMs appeared voluntary and should signal to both government and industry that current oversight may be insufficient. He suggested that stronger regulatory settings or supervisory mechanisms might be necessary to mitigate financial crime risks in the ATM sector.

Money Laundering Concerns

The ABC investigation highlighted instances where individuals convicted of proceeds of crime and tobacco offenses were able to load cash into Next Payments ATMs. Court records also revealed that a significant cannabis supplier in Darwin instructed an associate to load ATMs from atm2go with money from drug sales. Despite some parts of the private ATM industry disputing the potential for money laundering, concerns persist that private ATMs are not subject to anti-money laundering laws, allowing dirty money to be loaded into the machines.

If an unsuspecting individual withdraws this dirty money, their bank account could inadvertently credit the same amount cleanly into the private ATM cash-loader’s account. This process lacks the scrutiny that occurs when criminals attempt to deposit cash directly into a bank.

The ABC found over 20 stores selling illegal cigarettes with private ATMs inside, and at least five cases of ATM companies making deals with businesses linked to individuals charged or convicted of offenses, including illicit tobacco sales.

Case Study: Riverwood Store

One notable example is the Riverwood News Agency and Tobacconist in south-western Sydney, which was found selling illicit $10 packs of Double Happiness cigarettes. The store is registered to a company owned by Rui Chen, who did not respond to requests for comment. Chen had previously made headlines in 2020 for 15 tobacco sales breaches at the store, resulting in $4,250 in fines. Authorities had seized 241 cartons and 386 packets of illegal cigarettes, along with nearly six kilograms of loose leaf chop-chop tobacco, marking the local area’s largest-ever seizure at the time.

NCR’s Australian subsidiary had signed a deal with Chen’s company for an ATM in the same store 10 months after his conviction, according to mortgage records. Unlike many other stores selling illicit tobacco, the Riverwood outlet sold cigarettes for the same cash price as an electronic payment. The ABC does not suggest Chen was involved in money laundering.

The decision by NCR Atleos to remove ATMs from tobacco stores is a significant step in addressing the intersection of financial services and illicit trade. As the company continues to review its operations, the broader industry may need to consider enhanced regulatory measures to prevent the misuse of ATMs in illegal activities.