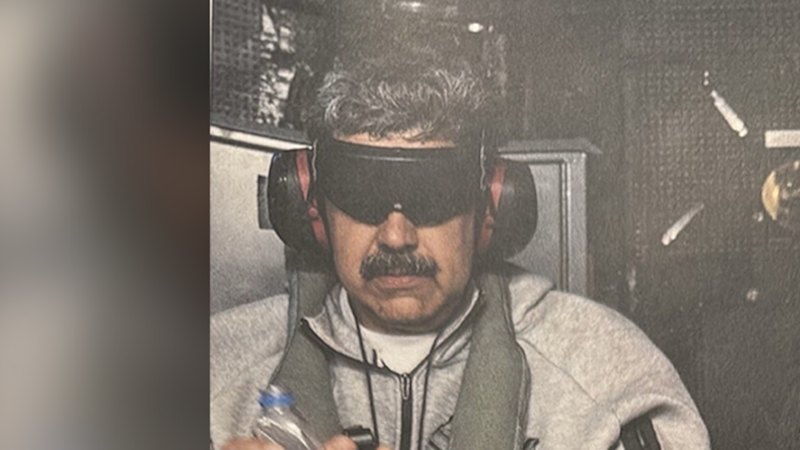

An unknown trader has reportedly secured a windfall of approximately $US410,000 ($610,000) after placing a high-stakes bet on the ousting of Venezuelan President Nicolás Maduro. This financial coup unfolded on the Polymarket prediction market, where the trader capitalized on contracts linked to Maduro’s removal, which initially suggested long odds prior to a dramatic weekend raid.

The trader’s strategic positions, valued at about $US34,000 before the operation against Maduro, skyrocketed in worth following the revelation of a U.S. military intervention targeting the Venezuelan leader. This development, as indicated by Polymarket data, has sparked interest and potential scrutiny from U.S. lawmakers advocating for more stringent insider trading regulations.

Political Repercussions and Legislative Response

The emergence of these trades has prompted Democratic Congressman Ritchie Torres to announce plans for a legislative proposal aimed at prohibiting elected officials, lawmakers, and federal employees from engaging in prediction market platforms. This move is part of a broader bipartisan initiative to curb potential misuse of non-public information in financial markets.

However, it remains uncertain whether House Speaker Mike Johnson will advance the bill to a vote, or if President Donald Trump would endorse it should it pass through Congress. The legislative landscape is poised for intense debate as the implications of such trading activities continue to unfold.

Inside the World of Prediction Markets

Prediction markets like Polymarket offer a unique trading environment where users can buy and sell yes-or-no contracts on a variety of real-world events, spanning sports, politics, and entertainment. These platforms have gained notoriety for their potential to yield substantial profits, especially when traders possess access to non-public information.

When a contract priced at a few cents pays out at $US1, traders who have access to non-public information tied to such contracts can rake in massive profits within hours or days.

Polymarket’s operations in the U.S. resumed in September following approval from the U.S. Commodity Futures Trading Commission (CFTC), subsequent to its acquisition of QCEX, a CFTC-licensed derivatives exchange. The CFTC has yet to comment on whether it is investigating trades related to Maduro’s capture.

Historical Context and Future Implications

This incident is not the first time Polymarket has faced scrutiny over potential insider trading. Despite restrictions preventing Americans from accessing the main platform, many circumvent these barriers using VPNs. The ongoing debate over the ethical and legal dimensions of prediction markets is likely to intensify as this case garners attention.

The anonymous trader’s account, created in late December, strategically acquired $US96 worth of contracts predicting a U.S. invasion of Venezuela by January 31. The trader increased their stake significantly just before the military action, as reported by The Wall Street Journal.

As lawmakers and regulatory bodies grapple with the complexities of prediction markets, the outcome of this legislative push could reshape the landscape for traders and policymakers alike. The potential for insider trading in such markets underscores the need for robust regulatory frameworks to ensure fair and transparent trading practices.

While Polymarket has yet to respond to inquiries regarding the Maduro trades, the platform’s future in the U.S. hangs in the balance as regulatory scrutiny intensifies. The evolving narrative of prediction markets will undoubtedly continue to captivate both financial and political spheres in the coming months.