In a surprising geopolitical maneuver, Indian Prime Minister Narendra Modi is set to visit China for the first time in seven years. This unexpected move comes in response to U.S. President Donald Trump’s decision to impose a 50% tariff on Indian goods, a significant economic blow that has pushed India into economic-emergency mode. The tariff makes India the second BRICS member, after Brazil, to face such a penalty from the United States.

The announcement follows Trump’s aggressive tariff policies, which have already impacted Brazil and South Africa. Brazil faced tariffs ostensibly due to its handling of former President Jair Bolsonaro’s alleged coup attempt, while South Africa was hit with a 30% tariff, the highest in sub-Saharan Africa. Other African nations like Nigeria, Ghana, Lesotho, and Zimbabwe face a comparatively lower 15% tariff.

Modi’s Strategic Shift Toward China

Facing the economic pressures of a 50% tariff, Modi has opted to attend the multilateral Shanghai Cooperation Organization meeting in Beijing on August 31, rather than heading to Washington. This decision signals a potential pivot in India’s diplomatic and economic strategies, as Modi seeks to mitigate the impact of U.S. tariffs by strengthening ties with China.

Trump’s tariff measures are partly motivated by his dissatisfaction with BRICS members’ efforts to challenge the U.S. dollar’s dominance as the world’s reserve currency. He accuses the bloc of aligning with “anti-American policies,” further escalating tensions.

“For Modi’s unbalanced economy, a 50% tariff is essentially a ‘trade embargo’ against the world’s biggest democracy, long a vital counterweight against China’s regional ambitions,” say economists at Nomura Holdings.

Economic Implications for India

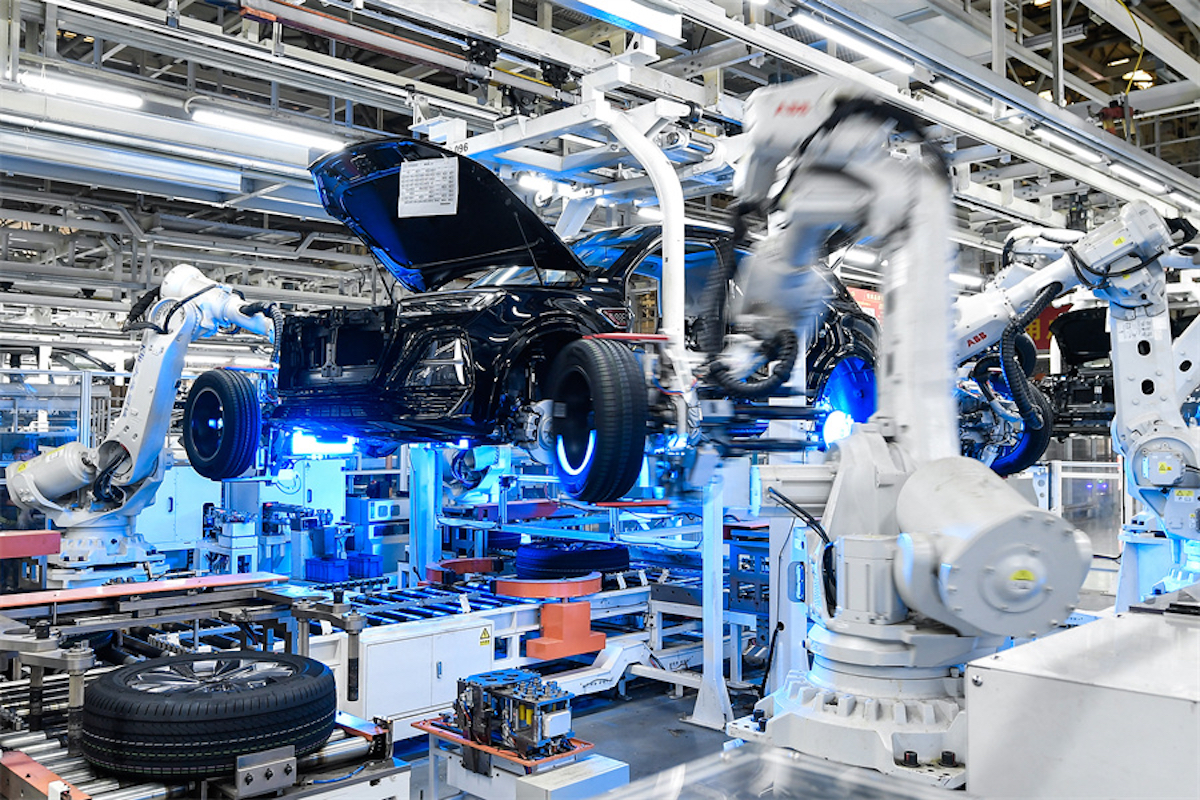

The tariffs threaten to undermine India’s position as an emerging manufacturing hub. Economist Shilan Shah from Capital Economics warns that the 50% tax is “large enough to have a material impact” on India’s economy, which is the fifth-largest globally. In 2024, India exported $87.4 billion worth of goods to the U.S., its largest trading partner.

Particularly vulnerable sectors include gems and jewellery, apparel, textiles, and chemicals. UBS economist Tanvee Gupta Jain suggests these industries might receive targeted government support to cushion the blow. Meanwhile, Rajat Agarwal, a strategist at Societe Generale, notes that the tariffs have already caused a weaker Indian rupee and increased currency volatility, affecting foreign investment flows.

Global Trade Dynamics and U.S. Relations

Trump’s tariffs on India could mark a pivotal moment in his broader trade war strategy. As Modi and Chinese President Xi Jinping meet, the dynamics between India and China could shift, complicating Trump’s efforts to secure a “grand bargain” trade deal with China. Recent tariff agreements with Japan and the European Union have already led to confusion and disputes over terms, particularly concerning automotive imports.

Richard Katz, from the Japan Economy Watch newsletter, highlights that U.S. automakers are concerned about being disadvantaged by Trump’s agreements with Japan and Europe, which allow for lower tariffs on their imports compared to those from Canada and Mexico.

In Europe, Trump demands that the EU purchase $750 billion of U.S. oil and gas, a move that European Commission President Ursula von der Leyen has resisted, citing the inability to force private companies into such deals for political reasons.

Domestic Reactions and Future Prospects

Back in India, Modi reassures key political constituencies, such as farmers, that he will not compromise their interests for U.S. demands. At an agricultural conference in New Delhi, Modi stated, “I will never compromise on the interests of farmers, livestock owners, and fishermen.”

India’s Gem and Jewellery Export Promotion Council has expressed deep concern over the tariffs, warning of disruptions to critical supply chains and threats to thousands of livelihoods. Business leaders like Anand Mahindra urge the government to improve the ease of doing business to counteract the economic risks posed by the tariffs.

Billionaire Anand Mahindra emphasizes, “We cannot fault others for putting their nations first, but we should be moved to make our own nation greater than ever.”

While some economists, such as those at Barclays, believe the tariffs will inflict visible damage on India, they also note that the domestic orientation of India’s economy could limit the pain. Morgan Stanley economist Bani Gambhir suggests that the Reserve Bank of India may need to increase efforts to boost growth, potentially through interest rate cuts and pausing fiscal consolidation efforts.

As BRICS members convened in Rio de Janeiro to discuss a potential rival currency to the U.S. dollar, Trump’s actions may inadvertently strengthen ties between India and China, two historically uneasy partners within the bloc. Economist Sarah Tan from Moody’s Analytics notes the difficulty BRICS faces in achieving its currency goals with India and China at odds, but Trump’s tariffs could change this dynamic.

As Modi’s visit to China unfolds, the world watches closely to see how this new alliance might reshape global economic and political landscapes, potentially surprising Washington and altering the balance of power.

Follow William Pesek on X at @WilliamPesek