Kerry Stokes’ Seven West Media is set to merge with Southern Cross Media, Australia’s largest radio company, in a transformative deal valued at $415 million. The merger will create a formidable television, radio, and publishing conglomerate, marking the exit of the billionaire from the media empire he established.

The merger, structured as a complex share swap, will see Southern Cross Media holding a 50.1 percent majority stake in the combined entity, while Seven shareholders will retain 49.9 percent. Southern Cross, known for the Triple M Network and the Hit Network, will join forces with Seven, which owns The West Australian newspaper and the Seven Network, holder of AFL and cricket broadcast rights.

Details of the Merger

Under the proposed agreement, Seven shareholders are set to receive 0.1552 Southern Cross shares for each Seven West Media share they hold. This deal, pending regulatory approval, is anticipated to conclude by early next year following a shareholder vote.

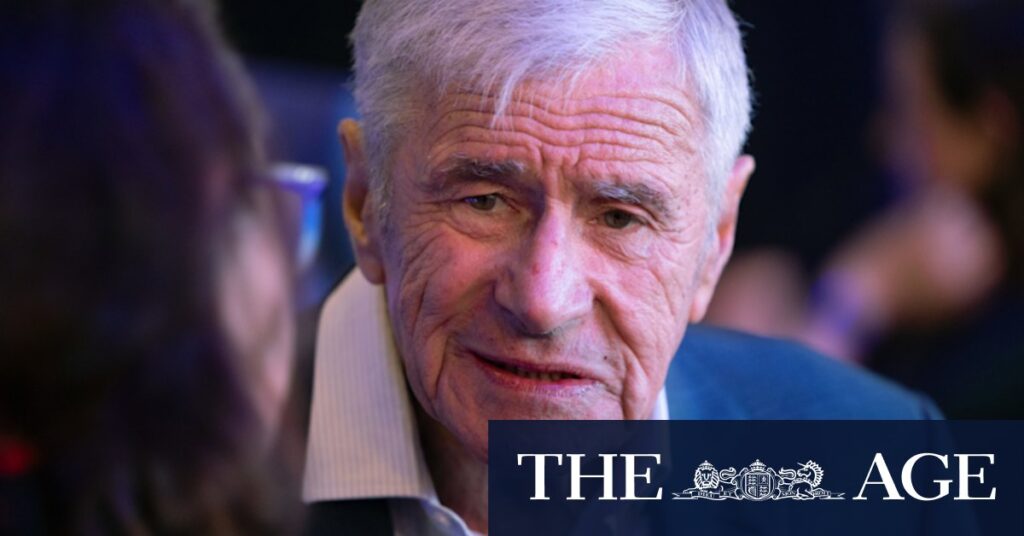

Upon completion, the new entity will be led by Seven’s CEO Jeff Howard, while Southern Cross CEO John Kelly will oversee the audio assets. Kerry Stokes, the influential chair of Seven, will step down from the board in February, with Southern Cross chair Heith Mackay-Cruise assuming the role. Stokes’ family will maintain a presence through his son Ryan, who will continue as a director, representing the family’s 20 percent stake.

“This is an important merger, as the combined company will be better able to serve both metropolitan and regional viewers, listeners, partners and advertisers,” Stokes stated.

Market Reactions and Strategic Implications

The announcement has sparked speculation about the future of the Stokes family’s involvement in the media business. Despite rumors, CEO Jeff Howard indicated no discussions about the family divesting their stake have taken place.

Seven West Media is also the largest shareholder in Southern Cross’ main competitor, ARN Media, with previous merger speculations. However, Southern Cross’ improved financial performance and rising stock value made the current share swap proposition more appealing.

Both companies saw their shares rise with the news, Seven increasing by 7.1 percent and Southern Cross by 3 percent, showcasing investor optimism.

Industry Perspectives and Challenges

Not all stakeholders are in favor. Gabriel Radzyminski, managing director of Sandon Capital, criticized the merger, fearing it could undermine Southern Cross’ recent growth. His firm has been advocating for changes within Southern Cross’ board for months. However, as Seven is the acquirer in this structured proposal, it does not require Southern Cross shareholder approval to proceed.

Media analyst Ben Willee from advertising agency Spinach highlighted the strategic advantages of the merger, noting the potential for enhanced sports programming and more efficient advertising campaigns through combined digital streaming services.

“Media companies are their own biggest clients, and now they can also unlock the power of cross-media promotion,” Willee commented.

Conclusion and Future Outlook

This merger underscores the need for local media companies to consolidate in the face of growing competition from international streaming giants. It positions the new entity as Australia’s fifth-largest media business, trailing only behind industry heavyweights like News Corp and Nine.

As the media landscape continues to evolve, the combined strengths of Seven and Southern Cross aim to offer a robust platform for both traditional and digital media consumers, setting the stage for future growth and innovation.