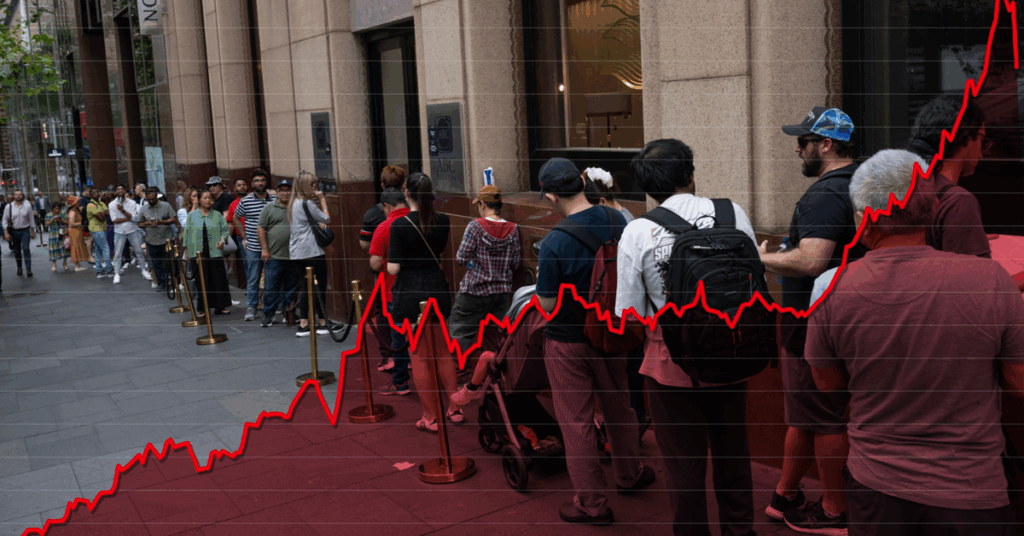

In recent weeks, particularly this Monday and Tuesday, people have been lining up for hours in Sydney’s Central Business District with one goal in mind: buying gold. However, the excitement was short-lived as the price of gold has since dropped sharply. On Tuesday, Australia woke up to the news that the precious metal had suffered its worst single-day fall since 2013, plummeting by a staggering 5.7 percent. The decline continued into Wednesday, with prices falling an additional 0.6 percent overnight.

This sudden downturn is a stark contrast to the astronomical rise in the price of gold earlier this year. The precious metal hit a record high of approximately $US4380 per ounce, or about $6755 for 31 grams, marking a more than 55 percent increase since the start of 2025. The surge was particularly pronounced in October, with prices climbing by roughly $US400 in just 11 days. However, within a couple of days, the price slid back to around $US4080.

Understanding the Gold Rush

The recent rise in gold prices has been largely attributed to its status as a safe-haven asset. Amid global geopolitical and economic turmoil—including Donald Trump’s tariffs, conflicts in Ukraine and the Middle East, persistent global inflation, and a US government shutdown—investors have flocked to gold for security. However, the latest price drop suggests that other factors may be at play.

Despite initial speculation that easing global tensions might have triggered the plunge, the continued decline even as Russia showcased its intercontinental missile capabilities suggests otherwise. Instead, experts believe the rise may have simply reached its natural peak.

“There’s a classic market adage that goes something like ‘when financial news moves from the business pages to the front page, the top is near’,” said Ray Attrill, NAB’s head of FX Strategy. “Wednesday’s correction in the gold (and silver) price might be best seen in this context.”

Market Reactions and Investor Sentiments

According to Attrill, the recent surge in gold prices has been driven by retail and private sector investors, with $US26 billion worth of gold purchased through ETFs in September alone. This influx of investment made a rush for profits inevitable, whether temporary or lasting.

Westpac senior economist Pat Bustamante echoed these sentiments, noting that there are “fears the astronomical rally has been overdone.” In a recent analysis, he wrote, “Investors appear to be taking profits given concerns the recent astronomical rally left gold and silver overvalued.”

Historical Context and Future Implications

Gold has experienced temporary and sometimes sharp dips throughout the year, including losing more than $US100 in a single day and around $US300 over a month once the initial panic from Trump’s “liberation day” tariffs subsided. Despite these fluctuations, gold remains on track for one of its best single-year performances.

“Gold is still up 57 percent year to date, far outpacing Bitcoin (up 17 percent) or any of the major global stock indices,” Attrill remarked.

However, this may offer little consolation to those who queued up to purchase gold earlier this week. As the market continues to react to shifting global dynamics, investors remain on edge, weighing the risks and opportunities of holding onto the precious metal.

The recent price movements underscore the volatile nature of the gold market and highlight the challenges faced by investors in predicting future trends. As geopolitical tensions and economic uncertainties persist, the demand for safe-haven assets like gold is likely to remain strong, albeit with potential fluctuations.

As the situation unfolds, market analysts and investors alike will be closely monitoring developments, seeking to understand the broader implications of these rapid changes in the gold market.