Europe is currently navigating a complex geopolitical landscape. With a persistently aggressive Russia, unpredictable trade tensions with the United States, and internal challenges related to migration, the continent is facing a multitude of pressures. Now, Europe must also contend with the economic implications of the so-called Second China Shock—a surge in high-tech exports from China that threatens to reshape global trade dynamics.

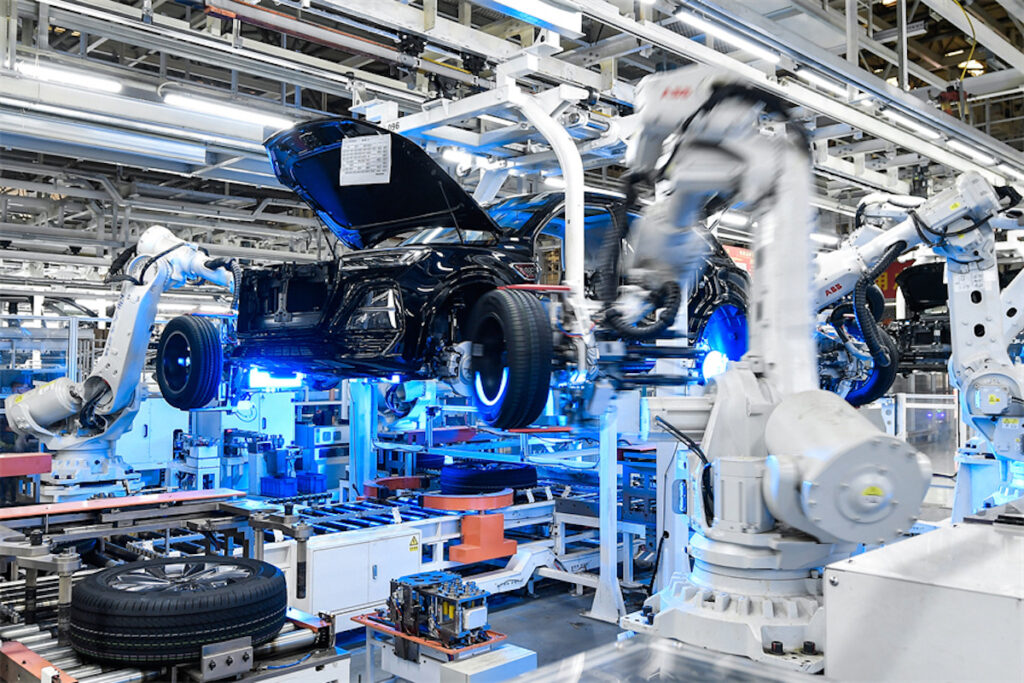

The Second China Shock refers to the recent influx of Chinese high-tech exports, a response to the country’s ongoing economic struggles following a real estate downturn that began in late 2021. To counteract domestic economic stagnation, the Chinese government, under President Xi Jinping, has implemented an expansive industrial policy aimed at boosting high-tech manufacturing. However, with Chinese consumers unable to absorb these products domestically, Chinese companies are aggressively targeting overseas markets, including Europe, with competitively priced goods.

The Economic Impact on Europe

Europe’s trade deficit with China has widened significantly due to this export surge. Several factors are amplifying this trend, including a depreciating Chinese currency, which has made Chinese goods even more affordable on the global market. According to Shanghai Macro Strategist, the combination of reduced prices and a weaker yuan has rendered Chinese products extraordinarily cheap, creating a competitive challenge for European manufacturers.

“A night at the Four Seasons Beijing costs roughly US$250, compared with more than $1,160 in New York. The price gap is so extreme that it no longer reflects relative productivity or income levels; it reflects a currency that has become fundamentally undervalued.”

Additionally, the lingering effects of tariffs imposed by the previous U.S. administration have redirected Chinese exports away from the American market and towards other regions, including Europe. This shift has been exacerbated by the end of certain tariff exemptions, prompting Chinese companies to seek new markets.

Strategic Concerns and Military Implications

While the influx of affordable Chinese goods might seem beneficial at first glance, there are strategic reasons for Europe to be cautious. The continent’s military capabilities could be compromised by deindustrialization. In the face of potential conflicts, particularly with Russia, Europe needs robust manufacturing sectors to support defense production. A reliance on imported goods could weaken Europe’s ability to rapidly scale up military production if needed.

Moreover, Europe’s trade relationship with China is becoming increasingly one-sided. As noted by Robin Harding of the Financial Times, China is not interested in importing goods it can produce domestically, leading to a trade imbalance that essentially amounts to Europe writing IOUs for Chinese imports.

“There is nothing that China wants to import, nothing it does not believe it can make better and cheaper, nothing for which it wants to rely on foreigners a single day longer than it has to.”

Economic Theories and Potential Solutions

Some economists argue that the benefits of trade with China might not be as mutual as traditionally believed. A report from Goldman Sachs suggests that increased Chinese exports could actually diminish global GDP outside of China, as domestic manufacturing sectors are displaced.

“Chinese displacement of domestic manufacturing swamps any positives from cheaper goods.”

To counter the Second China Shock, Europe may need to consider protectionist measures. This could involve implementing tariffs on Chinese goods to protect European industries and encourage domestic manufacturing. Additionally, Europe could incentivize Chinese companies to establish joint ventures within Europe, fostering technology transfer and local production capabilities.

Looking Ahead: A Balanced Global Economy

Addressing the challenges posed by the Second China Shock could lead to a more stable and balanced global economy. By imposing targeted tariffs and encouraging joint ventures, Europe could stimulate its own industrial sectors while promoting economic development in other regions. Furthermore, pressuring China to allow its currency to appreciate could alleviate some trade tensions and contribute to global financial stability.

Ultimately, Europe must take decisive action to resist the Second China Shock. Failure to do so could result in economic and strategic vulnerabilities that the continent cannot afford, especially given the array of other challenges it faces. By adopting a multifaceted approach that includes protectionism, strategic partnerships, and currency negotiations, Europe can safeguard its economic future and maintain its competitive edge on the global stage.