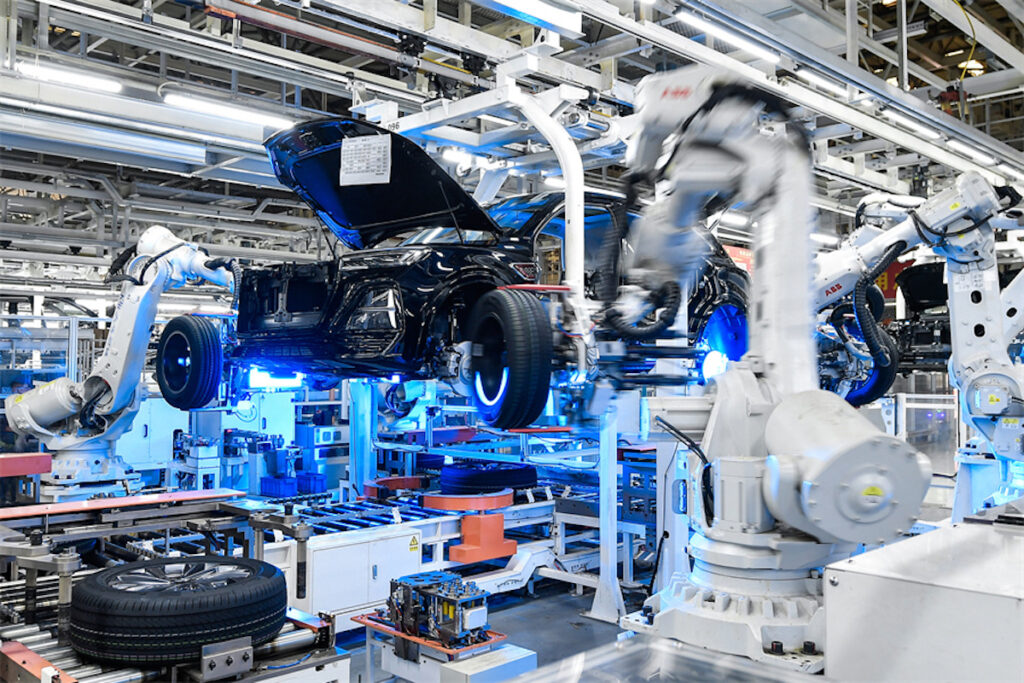

Europe is grappling with a multitude of challenges, from a belligerent Russia to internal migration issues, and now a new economic threat known as the “Second China Shock.” This term refers to the influx of high-tech exports from China that have flooded global markets in recent years. As China’s economy struggles with the aftermath of a real estate collapse that began in late 2021, the Chinese government has implemented an aggressive industrial policy to boost high-tech manufacturing across various sectors.

With domestic demand in China weakened, Chinese companies are exporting products like electric vehicles and machinery at reduced prices to international markets, including Europe. This has resulted in a significant trade deficit for Europe, exacerbated by China’s currency devaluation and the impact of U.S. tariffs under the Trump administration.

The Economic Impact on Europe

China’s export surge is supported by two main factors: a depreciated yuan and strategic shifts in trade policies. The yuan’s devaluation has made Chinese goods more affordable globally, creating a competitive disadvantage for European manufacturers. According to the Shanghai Macro Strategist, the currency’s current valuation is unsustainable for global trade balance:

“A night at the Four Seasons Beijing costs roughly US$250, compared with more than $1,160 in New York. The price gap is so extreme that it no longer reflects relative productivity or income levels; it reflects a currency that has become fundamentally undervalued.”

Additionally, while the U.S. has imposed tariffs on Chinese goods, prompting China to seek alternative markets, Europe has become a primary destination for Chinese exports. This shift has led to a booming trade relationship, albeit one that is heavily skewed in China’s favor.

Strategic and Economic Concerns

While some argue that Europe should embrace the influx of affordable Chinese goods, there are significant strategic and economic reasons to resist. Militarily, Europe’s reliance on imported goods could weaken its defense capabilities. With Russia’s military focus and China’s support, Europe may need to bolster its manufacturing sector to ensure readiness for potential conflicts.

Economically, Europe’s trade imbalance with China is unsustainable. As Robin Harding of the Financial Times points out, China is not interested in importing European goods, which leads to a reliance on IOUs rather than equitable trade:

“There is nothing that China wants to import, nothing it does not believe it can make better and cheaper, nothing for which it wants to rely on foreigners a single day longer than it has to.”

This situation creates a precarious financial position for Europe, which could lead to long-term economic decline if not addressed.

Potential Solutions and Future Outlook

To counter the Second China Shock, Europe may need to consider protectionist measures. While such actions could disrupt global trade systems, they might be necessary to safeguard European industries. Robin Harding suggests that Europe must become more competitive and explore new value sources, even if it means resorting to protectionism:

“The difficult solution [to the Second China Shock] is [for Europe] to become more competitive and find new sources of value…Which leads to the bad solution: protectionism.”

Implementing tariffs and trade restrictions specifically targeting China could help protect European manufacturing. Additionally, promoting joint ventures with Chinese companies could facilitate technology transfer and bolster European innovation.

Addressing China’s currency manipulation is another crucial step. Encouraging the appreciation of the yuan could alleviate trade tensions and promote a more balanced global economy. Such measures, while challenging, could pave the way for a more stable and equitable economic landscape.

Ultimately, Europe must act decisively to resist the Second China Shock. By doing so, it can protect its industries, maintain military readiness, and secure its economic future in the face of mounting global challenges.