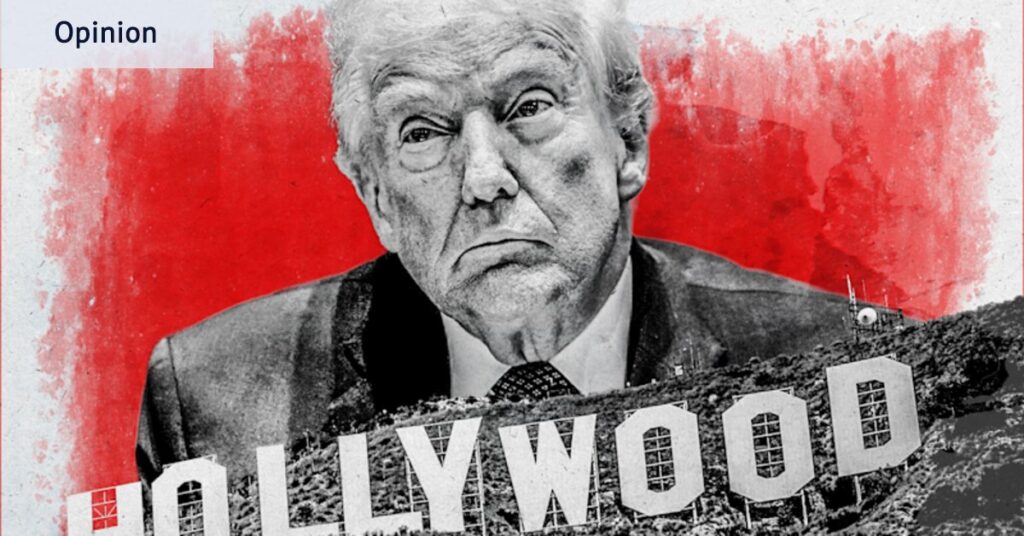

The starting bell has been rung for a high-stakes showdown between entertainment industry giants, as the future of Hollywood hangs in the balance. Former reality TV star and U.S. President, Donald Trump, is poised to play a pivotal role in this unfolding drama.

Netflix and Paramount Skydance are both vying to acquire Warner Bros Discovery, the powerhouse behind iconic franchises such as Harry Potter and Game of Thrones. This corporate clash, valued at $160 billion, promises to reshape the Hollywood landscape. Trump, known for his unconventional approach, is expected to have the final say in this contest.

The Stakes in Hollywood’s Corporate Arena

Typically, the Warner Bros board would evaluate both offers, making a recommendation to shareholders based on financial merits. Shareholders would then cast their votes. However, regulatory concerns loom large. A merger between Netflix and Warner Bros could trigger antitrust scrutiny from agencies like the Department of Justice and the Federal Trade Commission.

Netflix commands an 18% share of the U.S. streaming market, making it a formidable player. Paramount, too, is significant enough to attract regulatory attention. Yet, Trump’s influence could introduce unexpected twists in the decision-making process.

Trump’s Influence and Potential Impact

Trump has shown little regard for conventional governance, often placing obstacles in the path of decisions that don’t align with his interests. His recent threats to impose a 100% tariff on foreign-made films underscore his showbiz obsession and willingness to intervene in Hollywood affairs.

The competition is further complicated by the differing bids from Netflix and Paramount. While Paramount seeks to acquire all of Warner Bros, Netflix is interested only in HBO, the Hollywood studios, and streaming assets. Additionally, Netflix’s offer includes a mix of cash and shares, whereas Paramount offers cash alone, a preference for many shareholders.

Paramount’s Strategic Advantage

At first glance, Paramount seems to have the upper hand. Its bid is backed by financing from Affinity Partners, led by Trump’s son-in-law Jared Kushner, alongside investments from Trump-friendly Middle Eastern funds and the Ellison family. Larry Ellison, a close White House ally, is the father of Paramount head David Ellison.

Meanwhile, Netflix’s co-chief executive, Ted Sarandos, has made personal overtures to Trump, meeting him at the White House and at Trump’s Mar-a-Lago Club. Reports suggest Sarandos received a favorable reception regarding Netflix’s acquisition plans.

The Unpredictable Nature of Trump’s Decisions

Despite these maneuvers, predicting Trump’s stance remains challenging. His comments on the Netflix deal, stating it would “go through a process” and acknowledging the “big market share” as a potential issue, have already affected market perceptions.

Bets on prediction marketplace Polymarket showed a 23% chance of Netflix closing the acquisition by the end of 2026, down from about 60% just before Trump’s comments, according to Fortune.

Looking Ahead: The Future of Hollywood

This corporate battle underscores the evolving dynamics of Hollywood, where traditional decision-making processes intersect with political influence and global market forces. As the entertainment industry navigates this complex landscape, the outcome of this acquisition will have far-reaching implications for content production, distribution, and competition.

The world watches as Trump, the showman, takes center stage in this real-life drama, potentially altering the course of Hollywood’s future. Whether Netflix or Paramount emerges victorious, the reverberations of this decision will be felt across the industry for years to come.

As stakeholders await the final verdict, the question remains: How will Trump’s involvement shape the entertainment industry’s trajectory, and what does it mean for the global media landscape?