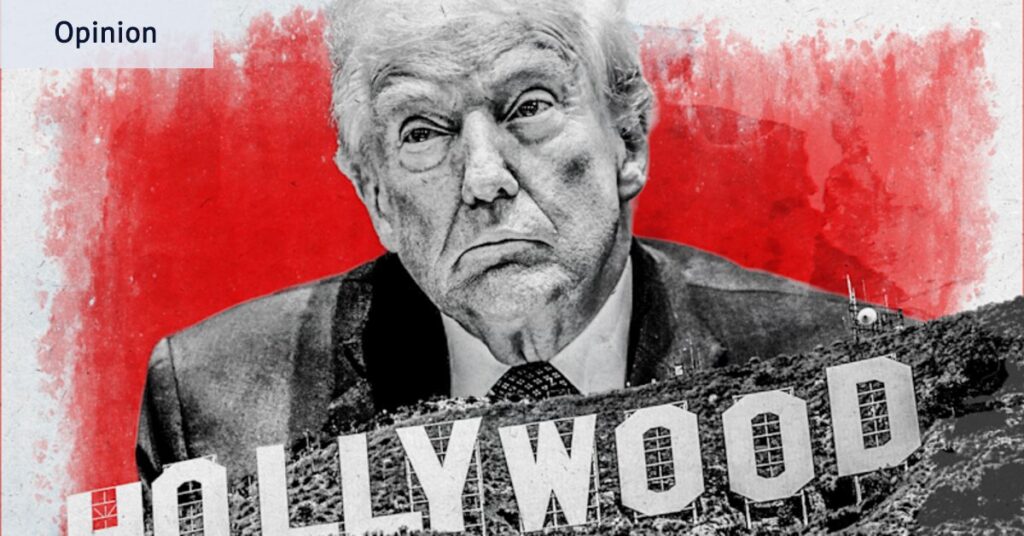

The starting bell has been rung for a high-stakes battle between entertainment industry giants that will shape the future of Hollywood. At the center of this unfolding drama is former reality TV star and U.S. President, Donald Trump, who is poised to play a pivotal role in determining the outcome.

Both Netflix and Paramount Skydance are vying to take over Warner Bros Discovery, the powerhouse behind franchises like Harry Potter and Game of Thrones. The outcome of this corporate duel, valued at $160 billion, could significantly alter Hollywood’s corporate landscape.

Trump, known for his unconventional approach, is expected to have the final say in this contest. While some question whether he should wield such influence, his involvement seems inevitable. The Warner Bros board would typically evaluate the offers and make a recommendation to shareholders, who would then decide. However, regulatory hurdles could complicate matters, especially given the potential antitrust concerns of a Netflix-Warner Bros merger.

Regulatory Concerns and Market Dynamics

Netflix, a dominant force in the global streaming market with an 18% share in the U.S., is likely to attract scrutiny from antitrust agencies like the Department of Justice and the Federal Trade Commission. Paramount, also a significant player, could face similar challenges if it merges with Warner Bros.

Trump’s track record suggests he may disregard traditional governance and decision-making processes, potentially placing obstacles before either bidder. In the U.S., Trump’s influence is formidable, and he has previously threatened to impose tariffs on foreign-made films, citing their impact on domestic content production.

Competing Offers and Strategic Alliances

The complexity of the bids adds another layer to the unfolding saga. Paramount seeks to acquire all of Warner Bros, while Netflix is interested in HBO, the Hollywood studios, and streaming assets. Netflix’s offer includes cash and shares, whereas Paramount is offering cash only, a preference for many shareholders.

Both companies recognize the importance of winning Trump’s favor. Paramount appears to have an advantage, with financing from Affinity Partners, led by Trump’s son-in-law Jared Kushner, and support from Trump-friendly Middle Eastern investment funds and the Ellison family. Larry Ellison, a key figure in the White House, is closely linked to Paramount’s leadership.

Netflix’s Strategic Moves

Netflix co-CEO Ted Sarandos has made personal overtures to Trump, meeting him at the White House and at Mar-a-Lago. Reports suggest Sarandos received a favorable reception regarding Netflix’s ambitions for Warner Bros, though the situation remains fluid.

“It will go through a process,” Trump commented on Sunday regarding the Netflix deal. “It is a big market share. It could be a problem.”

Market Speculation and Future Implications

Predicting the outcome of this corporate clash is challenging, with Trump’s unpredictable nature adding to the uncertainty. According to Fortune, bets on Polymarket showed a 23% chance of Netflix closing the acquisition by the end of 2026, a significant drop from earlier predictions.

As the entertainment industry watches closely, the implications of this battle extend beyond Hollywood. The decision could set precedents for corporate mergers and regulatory oversight in the media sector.

As events unfold, industry observers and stakeholders will be keenly watching for any indications of Trump’s intentions and how they might influence the final outcome. The future of Hollywood’s corporate landscape hangs in the balance, with Trump at the helm of this high-stakes drama.