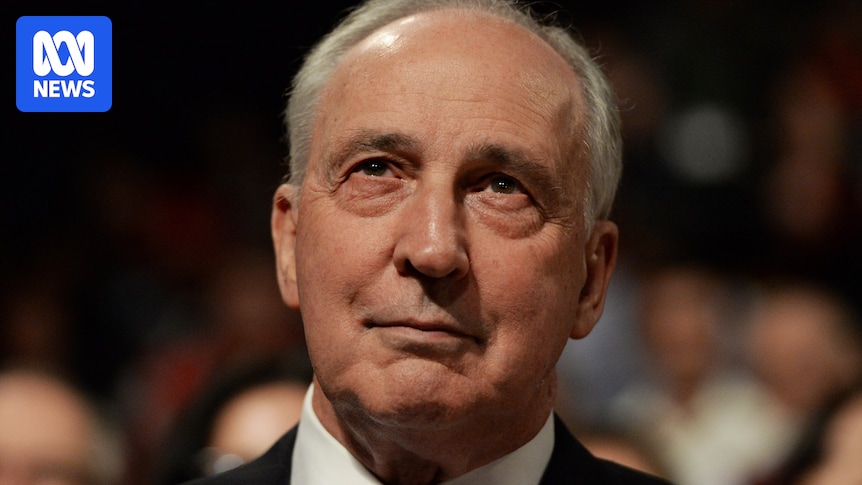

The Australian Taxation Office (ATO) has reversed its decision to collect nearly $1 million in interest and penalties from a company owned by former Prime Minister Paul Keating. This decision, made in 2015 after extensive negotiations with Keating and his financial advisers, has sparked debate over the ATO’s treatment of influential individuals and its transparency in handling settlements.

Typically, taxpayers challenging such decisions must pursue the matter in the Federal Court, a process often seen as lengthy and inaccessible for most. However, in this instance, the ATO canceled the payment notice following negotiations, prompting questions about potential preferential treatment for high-profile figures.

Background of the Tax Dispute

The controversy began in 2012 when the ATO discovered that Brenlex Pty Ltd, one of Keating’s companies, had not reported profits from a 2004 share sale. This was not the first time Keating’s tax affairs had come under scrutiny; in 2010, he settled over $3 million in tax liabilities with another company, Verenna Pty Ltd.

Despite assurances that Brenlex was up to date with its tax obligations, the ATO found it owed $446,000 related to the sale of shares in Lake Technology, a company Keating had advised. While Brenlex agreed to pay the tax debt, the ATO also demanded over $600,000 in accrued interest and penalties.

Negotiations and ATO’s Reversal

Keating’s advisers argued against the interest and penalties, citing an honest mistake and invoking the ATO’s “Commissioner’s discretion” rule to seek a write-off. Despite back-and-forth discussions throughout 2013 and 2014, the ATO initially refused to waive the charges.

By October 2014, the debt had grown to $904,000, and the ATO formally notified Brenlex that it would not remit the charges, emphasizing that the company had failed to account for the share disposal in its financial returns. In April 2015, Brenlex received a statutory demand to pay the debt, now nearly $953,396, within 21 days.

Keating personally intervened, arguing that the oversight was unintentional. His advisers claimed he mistakenly believed Brenlex had settled its tax obligations. Despite these efforts, the ATO maintained its stance until a last-minute plea in July 2015 led to a surprising reversal.

“I am able to confirm that the GIC and Late Lodgement Penalties … have been remitted in full,” the ATO’s email stated, reducing the debt to zero without explanation.

Implications and Public Reaction

The ATO’s sudden change of heart has raised eyebrows, particularly given the usual legal recourse required for such disputes. A joint submission to a Senate committee by five accounting bodies highlighted the rarity of such reversals, noting that the Federal Court is often the only option for taxpayers to contest ATO decisions.

These bodies criticized the lack of an internal ATO review process, stating that the court process is “lengthy and complex” and “out of reach of most taxpayers.” They emphasized the need for a “level playing field” in tax administration.

The Tax Ombudsman is currently reviewing the management of general interest charges to ensure fairness and consistency. The ATO, while not commenting on specific cases due to confidentiality, reiterated its stance that overlooking tax obligations is generally not grounds for canceling interest charges.

“However, there may be instances where GIC is remitted when a taxpayer inadvertently overlooks the requirement to lodge a form or make a payment, depending on the individual circumstances of the taxpayer,” the ATO noted.

Looking Forward: Calls for Greater Transparency

This case underscores the ongoing debate about transparency and fairness in the ATO’s dealings, especially concerning high-profile individuals. Critics argue that the lack of public scrutiny and clear guidelines for settlements can lead to perceptions of bias.

As the Tax Ombudsman continues its review, there are calls for reforms to ensure that all taxpayers, regardless of status, are treated equitably. The outcome of this review could lead to changes in how the ATO manages interest charges and handles taxpayer disputes in the future.

For now, the reversal of Keating’s debt remains a contentious issue, highlighting the challenges of balancing confidentiality with public accountability in tax administration.