The Gold Coast businessman at the center of a major financial scandal, David McWilliams, is accused of lavish spending despite the Federal Court freezing his assets. McWilliams, owner of the ALAMMC group, allegedly misused tens of millions of dollars intended for building homes for Australia’s most disabled citizens under the National Disability Insurance Scheme (NDIS).

McWilliams’ companies raised over $92 million from investors, promising to develop disability accommodations. However, the Australian Securities and Investments Commission (ASIC) claims that much of this money was squandered on gambling, luxury vehicles, and a Fijian resort. Despite a court order freezing his assets, McWilliams and his wife, Laura Fullarton, reportedly spent over $260,000 since November, according to ASIC’s allegations.

Establishing the Scheme

David McWilliams conceived his ambitious housing plan while residing in a luxurious Gold Coast apartment. The scheme aimed to leverage the Specialist Disability Accommodation (SDA) initiative, which offers up to $110,000 annually in rent to investors for housing profoundly disabled individuals.

The NDIS-backed scheme, launched in 2016, sought to transition people with profound disabilities from group homes and aged care facilities. Investors like Annette Williams from New South Wales saw it as both a noble cause and a lucrative opportunity. “I’m helping someone with my money, and at the same time it’s giving me a nice return,” she explained.

Marketing materials from ALAMMC highlighted the NDIS support, featuring slogans like “tenants’ rental income will be backed by the NDIS” and “helping high care NDIS participants lead happier lives.” These promises attracted investors like Victorian farmer Mick Schroeter, who invested $600,000 believing it was a government-backed, safe investment.

The Beginning of the End

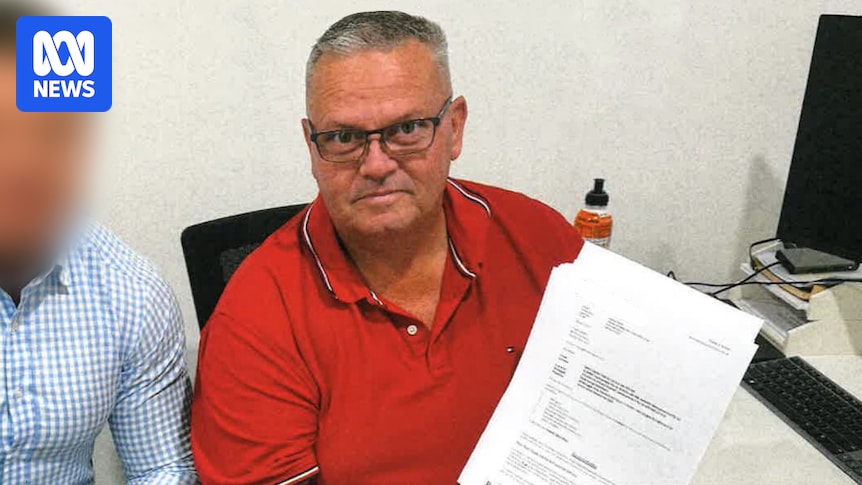

In September of last year, the scheme began to unravel. ASIC conducted raids on McWilliams’s Gold Coast apartment and office following a tip-off from the state gaming regulator about his gambling habits. It was revealed that McWilliams had funneled nearly $40 million through Star casinos over 17 months, losing approximately $4 million, suspected to be investor funds.

During the raid, ASIC discovered $112,000 in cash and cannabis-infused gummies in McWilliams’s apartment. Despite his claims that the money was casino winnings, the findings painted a grim picture of financial mismanagement. The ALAMMC office, adorned with expensive sports memorabilia, further underscored the lavish lifestyle funded by investor money.

Following the raids, investors like Mick Schroeter were left in disbelief. “It’s unbelievable,” he said. “He thinks you can just go in there and spend other people’s money, knowing that people have invested for a good cause? And he’s just gone in there and wasted it through his own greed.”

A Broader Investigation

The Federal Court placed McWilliams’s companies into receivership and froze his assets in November to preserve remaining funds while ASIC continued its investigation. Despite promises to build 12 disability projects nationwide, only a few had commenced. Court-appointed receivers found that McWilliams had spent millions on luxury cars, a Fijian resort, and cryptocurrency.

Efforts to recoup funds included selling McWilliams’s luxury property in Tallebudgera. However, court documents revealed ongoing extravagant spending by McWilliams and his wife, including $30,000 at a Gold Coast gambling venue and trips to Disneyland.

ASIC’s investigation is ongoing, with no charges yet filed. McWilliams has declined to comment, and attempts to reach him at his Gold Coast apartment were unsuccessful.

Unregulated Market and Investor Fallout

The collapse of ALAMMC and another company, Saorsa Health, has highlighted significant regulatory gaps in the disability housing sector. Saorsa, co-directed by Aiden Garrison, raised $49 million from investors but also collapsed, leaving behind questionable transactions like investments in a Cambodian dairy farm.

Receivers allege business connections between McWilliams and Garrison, including a $2 million payment of investor money to a company co-directed by Garrison. Investors like Annette Williams, who invested in both companies to diversify risk, were unaware of these connections.

Disability housing consultant Brent Woolgar criticized the lack of oversight in the sector.

“It’s astounding, to be honest, that this has been allowed to happen, but not surprising,” he said.

For investors like Mick Schroeter, the consequences have been devastating, losing $1 million and delaying retirement plans.

The SDA market, overseen by the NDIA and other agencies like the ACCC and ASIC, faces scrutiny. ASIC deputy chair Sarah Court stated that property investment schemes are now an “enforcement priority.” The NDIA emphasized the importance of thorough due diligence by investors.

Schroeter and others call for stronger government action. “At the end of the day, it’s our money and I think they should do something about it because they’re not protecting the Australian people,” he said. “I think they’re weak.”

As the investigation continues, the full impact of these schemes on investors and the disability community remains to be seen. The case underscores the need for robust regulation in sectors that serve vulnerable populations.