In a significant development for investors eyeing the Australian Securities Exchange (ASX), one broker is forecasting substantial growth for technology stock Weebit Nano Ltd. As Australia’s digital economy continues to expand, Weebit Nano has emerged as a promising player, potentially offering substantial returns that could see its share price triple.

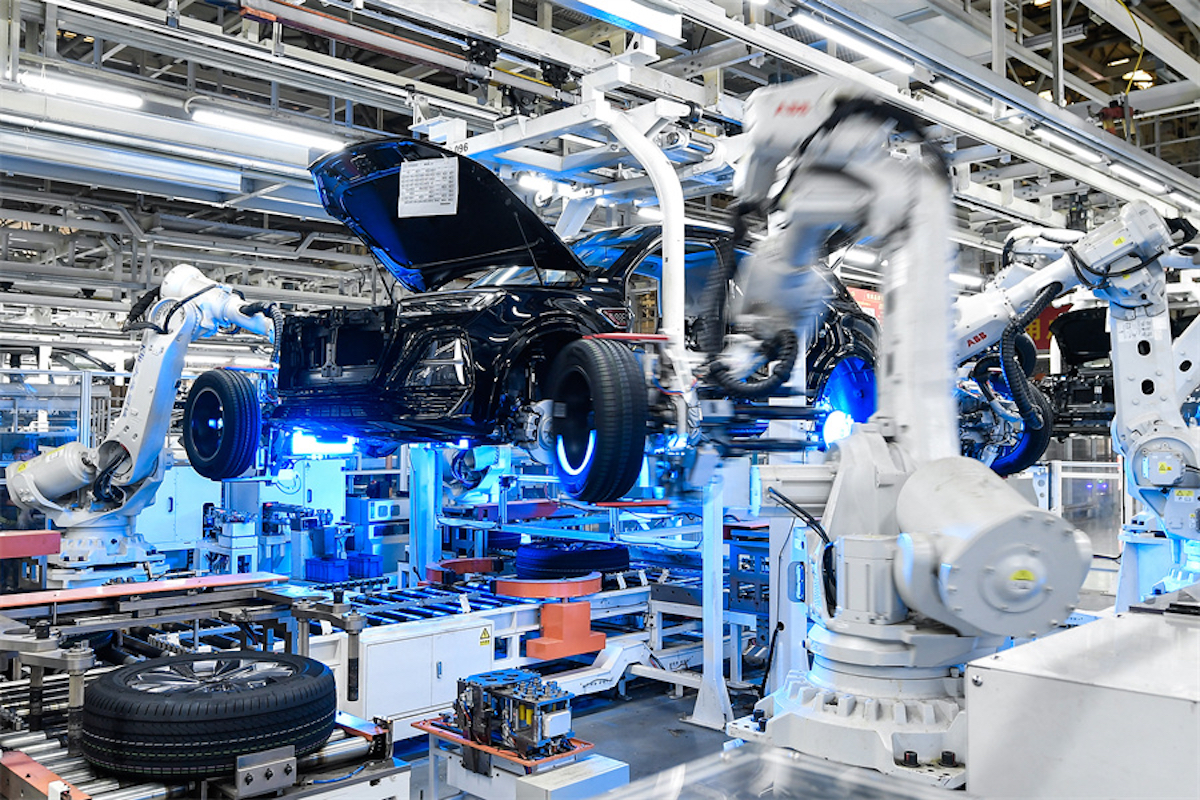

Weebit Nano Ltd, an Israel-based company, specializes in the development and licensing of semiconductor memory technology. Its focus on Resistive Random-Access Memory (ReRAM) technology positions it at the forefront of innovation, catering to sectors such as Internet of Things (IoT) sensors, smartphones, robotics, autonomous vehicles, 5G communications, advanced AI systems, and cloud computing.

Volatile Yet Promising Market Performance

Like many small-cap stocks, Weebit Nano has experienced a volatile share price over the past year. It reached a peak of $3.60 per share in December last year, only to dip to $1.39 in April. Currently, the stock is trading at approximately $2.17 per share. Despite this volatility, broker Bell Potter has issued a buy recommendation, setting a price target of $6.11, suggesting a potential tripling of the share price.

According to Bell Potter, a hypothetical investment of $5,000 at the current price could yield approximately $14,072 if their prediction materializes.

Key Factors Behind the Optimistic Outlook

Bell Potter’s positive outlook for Weebit Nano is rooted in the company’s recent achievements and future potential. Notably, Weebit Nano has secured AECQ100 qualification, a significant milestone demonstrating the robustness of its technology. This qualification ensures the technology can operate at extreme temperatures of 150 degrees Celsius for up to 10 years and endure 100,000 cycles of use.

Furthermore, Weebit Nano has successfully produced working wafers with DB HiTek and prepared functional demonstrations for an upcoming power management conference in Germany. These developments underscore the company’s technological capabilities and readiness to meet industry demands.

Implications of AECQ100 Qualification

The AECQ100 qualification is crucial for Weebit Nano as it opens doors to markets requiring high-reliability chips, such as automotive, industrial machinery, and aerospace sectors. In these environments, components must withstand extreme conditions, making the qualification a testament to the durability and reliability of Weebit Nano’s ReRAM technology.

Strategic Position and Market Opportunities

Weebit Nano’s strategic position as the only independent provider of ReRAM technology provides it with a unique market opportunity. The company plans to ramp up production and secure additional agreements throughout the year, potentially enhancing its market share and revenue streams.

Industry experts suggest that as the demand for advanced memory technology grows, Weebit Nano’s position could strengthen further. The company’s ability to innovate and adapt to market needs will be crucial in maintaining its competitive edge.

Weebit Nano’s ReRAM technology is poised to revolutionize sectors that require high-performance memory solutions, offering significant growth potential for investors.

Looking Ahead: Challenges and Opportunities

While the outlook is optimistic, Weebit Nano must navigate several challenges to realize its full potential. The semiconductor industry is highly competitive, with rapid technological advancements and shifting market dynamics. Weebit Nano’s success will depend on its ability to innovate continuously and secure strategic partnerships.

As the global demand for semiconductor technology increases, Weebit Nano’s focus on expanding its production capabilities and entering new markets will be critical. Investors and industry observers will be keenly watching the company’s next moves and its ability to deliver on its growth promises.

In conclusion, Weebit Nano’s potential for significant growth makes it an attractive option for investors seeking exposure to the burgeoning technology sector. With strategic positioning and robust technology, the company is well-placed to capitalize on emerging opportunities, although it must remain vigilant in addressing industry challenges.