As President Donald Trump continues to implement his aggressive trade policies and pressures the Federal Reserve, financial markets in the United States remain surprisingly unfazed. Despite tariffs and attempts to influence monetary policy, major indices like the S&P 500 and Nasdaq have seen gains of over 7% and 8.6% respectively this year. Meanwhile, bond yields have declined, suggesting a market that is either dismissive or confident in its ability to weather the Trump administration’s economic maneuvers.

The resilience of U.S. markets contrasts sharply with global apprehension. The “TACO” trade—an acronym for “Trump Always Chickens Out”—suggests that investors believe Trump will ultimately back down from his most severe threats. However, this perception may underestimate the potential long-term impacts of his policies.

Understanding Trump’s Tariffs

Trump’s tariffs are more than mere threats; they are active measures affecting various sectors. A 10% baseline tariff is already in place, along with specific tariffs on steel, aluminum, and other imports from China, Canada, and Mexico. These tariffs are set to expand with new “reciprocal” tariffs scheduled for August 1. These measures are expected to intensify the effects of ongoing trade wars, potentially leading to increased inflation and impacting corporate profits.

Recent data shows inflation rising to 2.7%, slightly above the Federal Reserve’s target of 2%. This uptick is partly attributed to tariffs, as importers face higher costs and pass these on to consumers. Retailers are already discussing price increases to offset these tariffs, indicating a ripple effect through the economy.

Corporate Impact and Economic Consequences

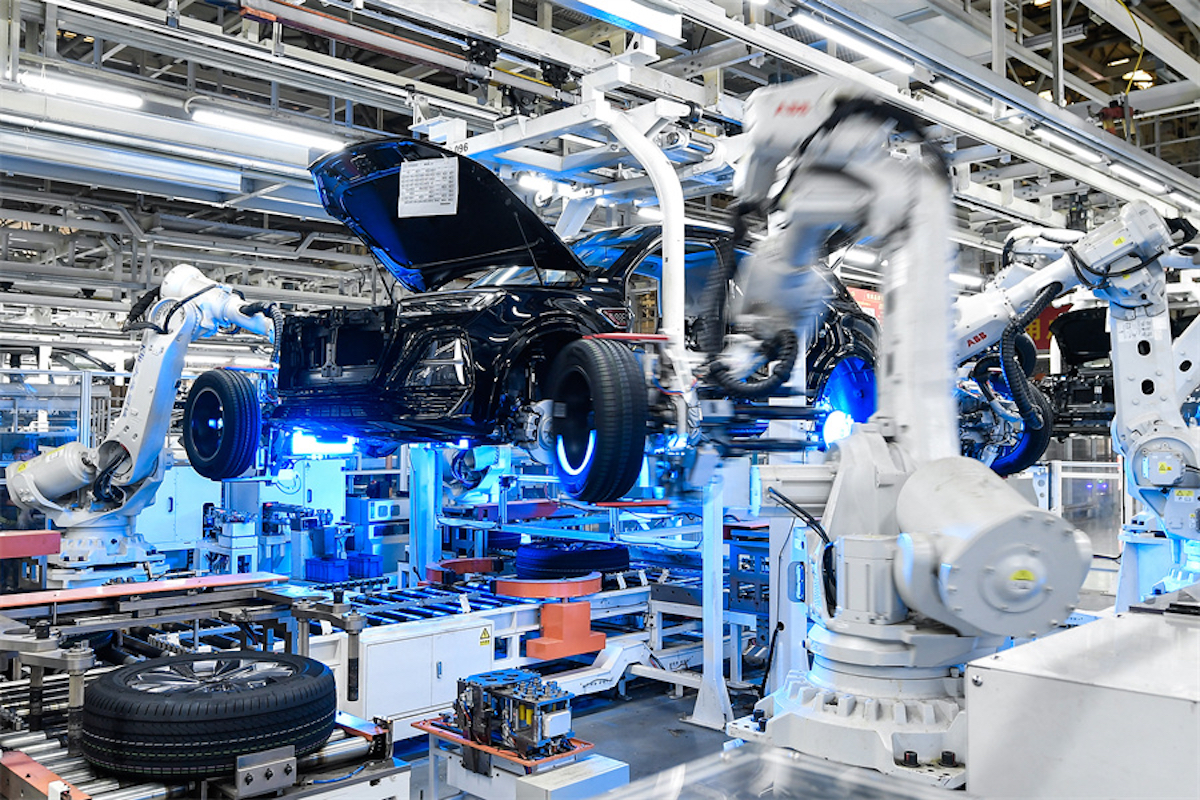

Major corporations are beginning to feel the pinch. Stellantis, the parent company of Chrysler and Jeep, reported a €2.3 billion loss in the first half of the year, attributing €300 million of this to tariffs. Similarly, General Motors has projected a $4.5 billion impact from tariffs this year, primarily due to its reliance on imports from Mexico and South Korea.

While car prices have not yet surged, this may be due to consumers preemptively purchasing vehicles before tariffs take full effect. As inventories dwindle, the true cost of tariffs is likely to become more apparent, potentially leading to higher prices and reduced consumer spending.

The Fed and Fiscal Policy Under Pressure

Trump’s influence extends beyond trade, as he continues to pressure the Federal Reserve to cut interest rates. His desire to appoint a Fed chair who aligns with his views threatens to politicize the institution, potentially leading to a steepening yield curve. Short-term securities might see falling yields, while long-term bonds could rise, reflecting fears of inflation.

The economic landscape is further complicated by the “One Big Beautiful Bill,” which added new tax and spending measures to Trump’s 2017 tax cuts. The Congressional Budget Office estimates this will add $3.4 trillion to the national debt over the next decade, raising concerns about fiscal sustainability.

Global Reactions and Future Implications

International investors appear more cautious about Trump’s policies than their American counterparts. The combination of tariffs and potential Fed politicization could stifle economic growth and exacerbate inflation. With the S&P 500 trading at high valuations, any significant rise in interest rates could severely impact share prices.

As the August 1 deadline for new tariffs approaches, the market’s calm demeanor will be tested. The potential appointment of a Fed chair aligned with Trump’s policies could further unsettle investors. The coming months will reveal whether the U.S. economy can maintain its current trajectory or if Trump’s policies will lead to broader economic challenges.