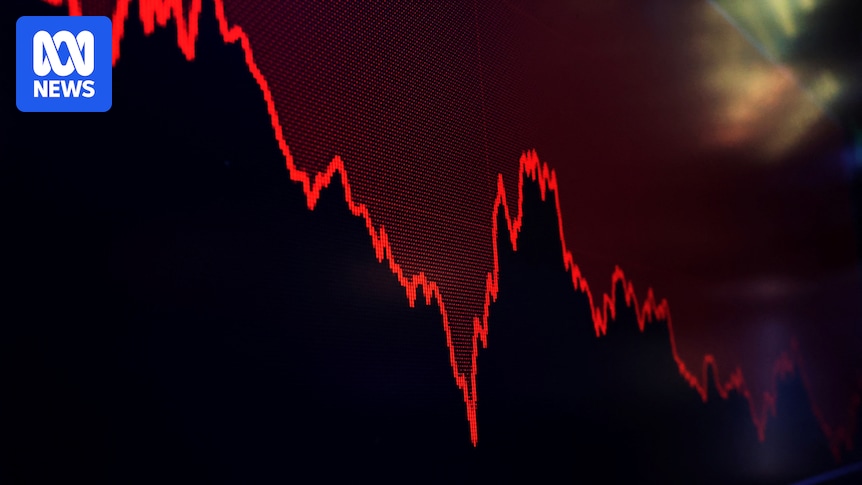

Wall Street experienced a significant downturn as President Donald Trump’s controversial intentions to acquire Greenland triggered a sell-off in US assets. The market turbulence was evident with the Dow Jones, S&P 500, and Nasdaq all witnessing substantial declines, while the US dollar also weakened.

As of 10:10am AEDT, the Dow Jones had fallen by 1.8%, the S&P 500 by 2.1%, and the Nasdaq by 2.4%. This market reaction followed Trump’s threats to impose tariffs on European countries opposing his Greenland plans. The Australian dollar, meanwhile, rose by 0.3% to 67.3 US cents, reflecting a broader trend of the US dollar’s decline.

Impact on Global Markets

The ripple effects of the US market’s volatility were felt globally. European markets, including the FTSE and DAX, also reported declines, while commodity prices such as gold surged. Spot gold prices increased by 2% to $4,762 per ounce, as investors sought safe-haven assets amidst geopolitical uncertainties.

Oil prices saw a modest rise, with Brent crude inching up by 0.1% to $64 per barrel. The demand for gold and other commodities was further fueled by a sliding US dollar, which makes dollar-priced assets cheaper for international buyers.

ASX and Resource Stocks

In Australia, the ASX 200 dropped by 0.3% to 8,789 points. However, resource stocks, particularly gold miners, bucked the trend. Companies like Westgold, Evolution Mining, and Bellevue Gold saw their shares climb between 3% and 8%, driven by record gold prices.

Other sectors, such as technology and financials, faced pressure, with firms like Xero and DroneShield experiencing declines. Lynas Rare Earths, however, reported a 43% rise in revenue, boosting its shares by 4.3% despite production challenges.

Expert Insights and Future Outlook

According to Seema Shah, Chief Global Strategist at Principal Asset Management, the current market conditions reflect a broader uncertainty fueled by geopolitical tensions and economic policies. “The market’s reaction underscores the fragility of investor confidence in US assets,” she noted.

Alan Kohler, a finance analyst, highlighted the paradox of strong US market performance despite economic policy uncertainty. “While AI optimism boosts the market, Trump’s unpredictable moves create a counterbalance,” he explained.

Global Economic Implications

The sell-off in US assets is part of a larger trend known as the “sell America” trade, where investors divest from US markets in favor of safer alternatives. This trend is exacerbated by Japan’s rising borrowing costs, which have historically influenced global market dynamics.

Japan’s bond market faced significant sell-offs, with yields reaching record highs amid political shifts and anticipated fiscal spending. This development contributed to the global market’s volatility, affecting investor sentiment worldwide.

Meanwhile, Canadian Prime Minister Mark Carney’s remarks at the World Economic Forum emphasized the need for middle powers to collaborate in the face of shifting global dynamics. His comments, though not directly naming Trump, criticized the use of economic integration as leverage by major powers.

Conclusion and Next Steps

The ongoing market volatility highlights the complex interplay between geopolitical ambitions and economic realities. As the situation unfolds, investors will be closely monitoring developments in US-Europe relations and the potential for further market disruptions.

With the ASX poised for another challenging day, the focus will remain on resource stocks and the Australian dollar’s performance. As global markets react to these shifts, the need for strategic investment and risk management becomes increasingly critical.