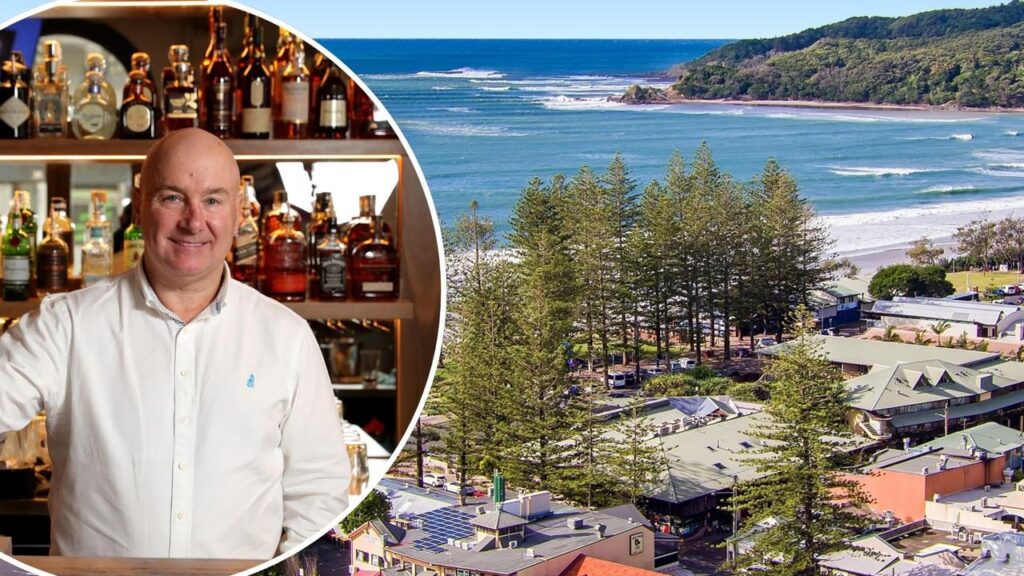

A frothy pub market underscored a string of mega deals for landmark Australian hospitality venues that ushered in new owners in 2025. The $140 million sale of Byron Bay’s iconic Beach Hotel headlined these high-profile trades, marking the nation’s second most expensive hotel sale on record.

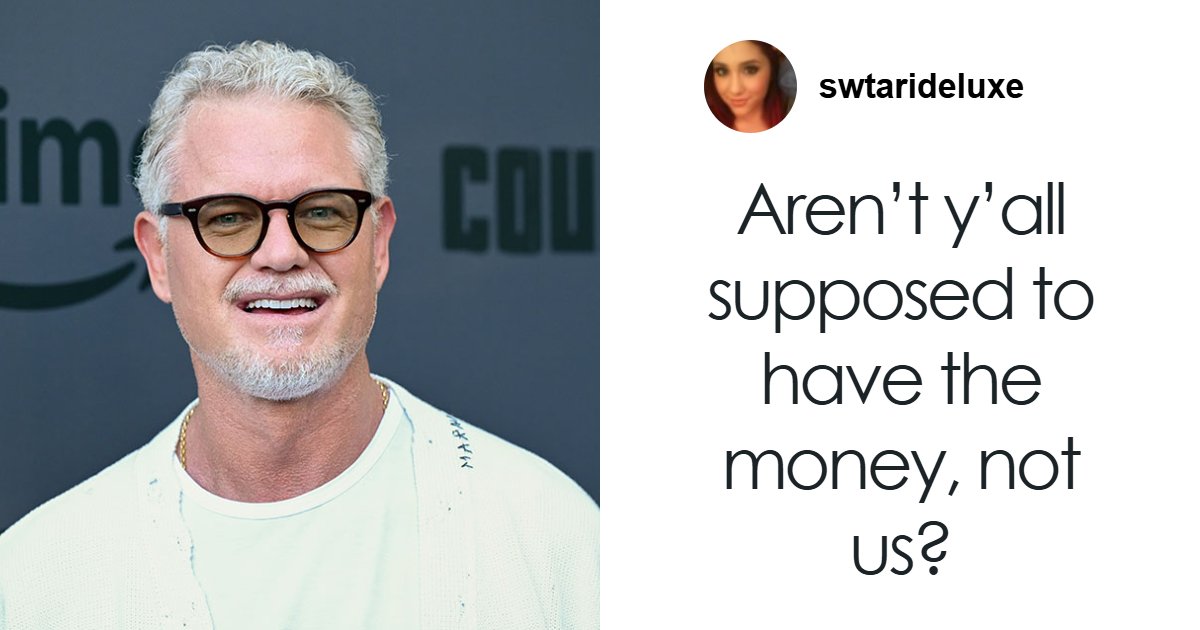

Businessman Scott Didier, the group CEO of Johns Lyng Group, added ‘The Beachie’ to his family’s growing portfolio in the region. The venue is a favorite among locals, including Hollywood A-lister Chris Hemsworth, who calls Byron Bay home. “We are sure it will continue to thrive as a beloved part of the Byron Bay landscape under the guidance of the Didier family,” Redscape Hospitality managing director Chris Unger said when confirming the sale in May.

High-Profile Transactions and Market Trends

In another notable trade, billionaire Sydney Roosters chairman Nick Politis recently completed a $50 million deal for Queensland’s most iconic pub, The Caxton Hotel. This transaction marks the end of an era for the Farquhar family, which had owned the famous rugby league hotel for 28 years. The Caxton, first opened in 1864, is a magnet for fans who gather in their thousands around State of Origin clashes before walking to nearby Suncorp Stadium.

These sales highlight the growing popularity of Australian trophy pubs for family offices and high-net-worth individuals. JLL reported a notable trend towards “the outsized role of private capital” in 2025 as transaction volumes in the hotel sector surged above $2 billion.

South of the Border: More Landmark Sales

South of the border, several owners sought to capitalize on the strengthening market by selling long-held venues. Sydney’s landmark Crystal Palace Hotel, located across the road from Central Train Station, sold to the Feros family’s JDA Hotels in an off-market deal. Records show the property traded for $13.5 million.

In North Sydney, publican Mark Barry sold the Firehouse Hotel after 25 years, during which it was converted from a heritage-listed fire station to a favored watering hole. Meanwhile, The Good Beer Group sold the Union Hotel to Aston Waugh’s Watering Hole Hotels for $22 million.

Another Australian icon, the original Ettamogah Pub, just off the Hume Highway near Albury, is currently on the market for around $50 million, which includes the rights to the brand.

Melbourne’s Hospitality Scene Transformation

Changes are also afoot in Melbourne’s CBD, where billionaire Justin Hemmes unveiled his vision to transform a car park into a new high-end entertainment precinct. He paid $55 million for the eight-storey complex in Little Collins Street, a “passion project” where he hopes to create restaurants, bars, a boutique hotel, and a skygarden. “We want to create the most exciting and iconic destination, not only for the city of Melbourne and the people of Melbourne, but an iconic destination within Australia,” he said.

Just a few blocks away, the hospitality group behind Nomad has taken over Guy Grossi’s stable of venues, including Floretino, The Grill, Cellar Bar, Ombra, and Arlechin. New owners with an appetite to continue the legacy of Great Ocean Road dining institution Chris’s Beacon Point have also been found. Nicole Kidman, Tom Cruise, and gridiron giant Joe Montana are big names who dined at the Skenes Creek eatery, which sold for $3 million in July.

Another international dining destination, the Birregurra farm that is home to the world-renowned Brae restaurant, hit the market in November with $5 million price hopes.

Implications and Future Prospects

The wave of sales in the Australian pub market reflects a broader trend of increased interest from private investors and family offices in hospitality assets. As the market continues to heat up, industry experts anticipate further high-value transactions and a reshaping of the hospitality landscape. The influx of private capital suggests a shift towards more personalized and diversified ownership, potentially leading to innovative developments and revitalized venues.

Looking ahead, the continued interest in iconic Australian pubs and hospitality venues signals a robust future for the sector, with potential for growth and transformation driven by new ownership and investment strategies.