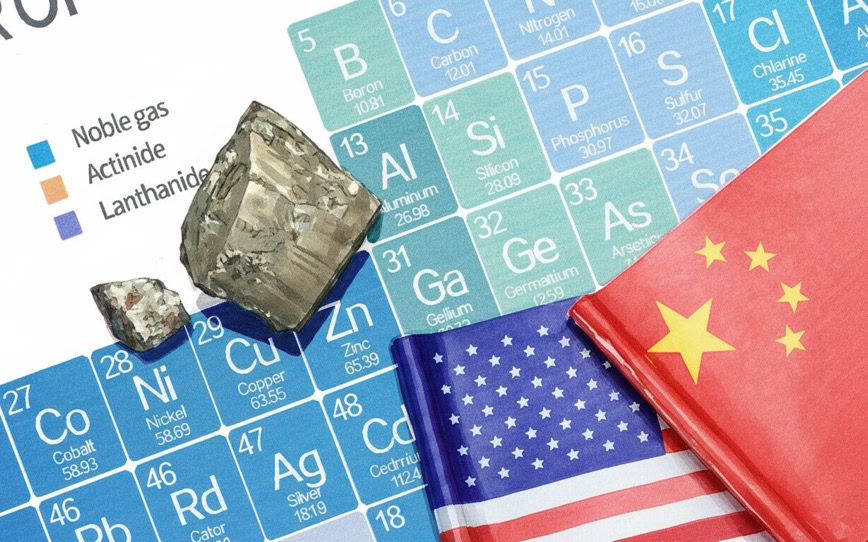

China has dramatically expanded its export controls on rare earth elements, adding five new materials and a range of refining technologies to its restricted list. This move, announced Thursday by China’s Ministry of Commerce, tightens Beijing’s grip on global supply chains for critical minerals.

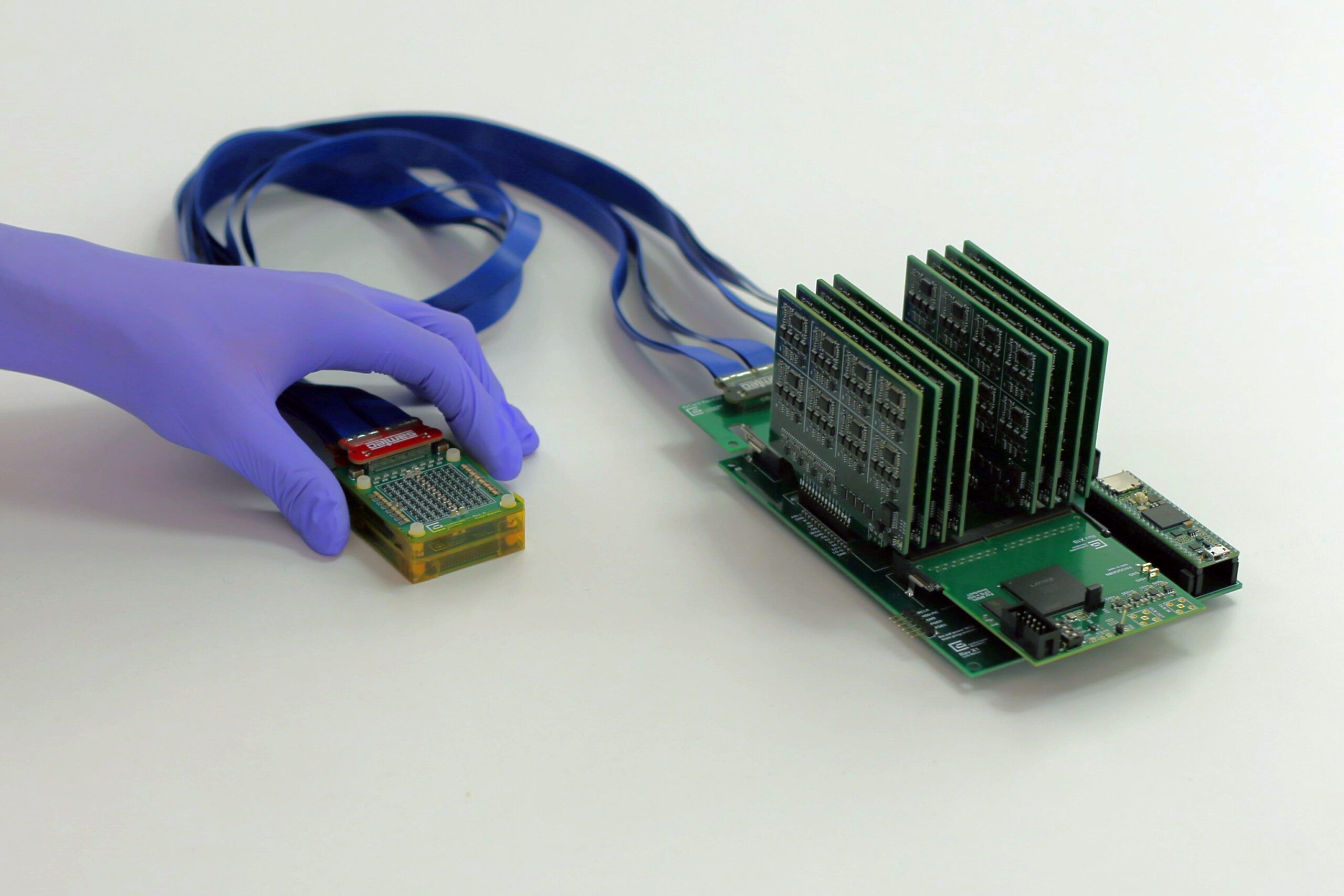

The latest measures introduce new licensing requirements for the export of holmium, erbium, thulium, europium, and ytterbium. These elements are essential in manufacturing electric vehicles (EVs), wind turbines, semiconductors, aircraft engines, and defense technologies. The announcement also extends to certain refining technologies and, for the first time, imposes restrictions on foreign producers using Chinese rare earth materials or equipment, even if no Chinese entities are directly involved in the transaction.

Global and US Reaction

The move comes ahead of a scheduled meeting between Presidents Donald Trump and Xi Jinping later this month in South Korea. It is widely viewed as a strategic escalation, highlighting China’s dominance in a sector where it processes more than 90% of the world’s rare earths.

This development follows calls from US lawmakers earlier this week to broaden bans on the export of chipmaking equipment to China, escalating the technology standoff between the two powers. The White House stated it is “closely assessing any impact from the new rules,” describing the sudden expansion as an attempt by Beijing to “exert control over the world’s technology supply chains.”

US-listed rare earth and critical minerals stocks rallied on the news. Critical Metals Corp jumped 17%, Energy Fuels rose 11%, and both MP Materials and USA Rare Earth climbed more than 6% in New York trading.

What It Means for Australia

For Australia, which is rapidly positioning itself as a non-Chinese supplier of critical minerals, the latest development could accelerate investment interest in ASX-listed companies with rare earth exposure in North America. The US is now actively funding domestic supply chain projects.

Potential Beneficiaries

- Arafura Rare Earths (ASX: ARU) — Developer of the Nolans Project in the Northern Territory and a strategic supplier to global EV manufacturers, already aligned with US and European decarbonization efforts.

- Vital Metals (ASX: VML) — Operator of the Nechalacho Project in Canada’s Northwest Territories, one of the few rare earth mines outside China already in production, with processing ties in North America.

- Iluka Resources (ASX: ILU) — Through its planned Eneabba rare earth refinery, positioned to become a key Western alternative in refining capacity.

- American Rare Earths (ASX: ARR) — With significant projects in Wyoming and Arizona, directly aligned with Washington’s strategic goal of securing critical mineral supply from US soil.

- Hastings Technology Metals (ASX: HAS) — Advancing the Yangibana Project in WA, with established partnerships in Europe and growing interest from US buyers seeking diversification.

These companies stand to benefit not only from higher rare earth prices but also from potential strategic investment flows out of the United States, which continues to fund domestic and allied sources of critical minerals.

A Structural Realignment

Industry analysts describe the move as the latest step in a “structural bifurcation” of global supply chains. China appears intent on localizing its rare earth and semiconductor value chains, while the US, Europe, and allied partners, including Australia and Canada, are racing to build alternative refining and processing capacity.

“The world is effectively splitting into two parallel ecosystems for critical materials,” said Neha Mukherjee, a rare earths analyst with Benchmark Mineral Intelligence. “China is securing its own downstream integration, while the US and its partners are accelerating investment in non-Chinese supply chains.”

China’s new restrictions will take effect on November 8, with additional compliance measures for foreign companies to follow on December 1, adding a new layer of complexity to an already fragile supply chain.

The announcement comes as global markets brace for the potential impacts of these new restrictions, which could reshape the landscape of critical mineral supply chains worldwide. As countries like Australia and the US seek to diversify their sources, the geopolitical and economic ramifications of China’s strategic maneuvers will likely continue to unfold in the coming months.