DroneShield, a prominent player in the anti-drone technology sector, has emerged as the most sought-after small cap stock over the past year. This Australian-based company has outperformed both technology and uranium stocks, capturing significant interest from local fund managers. The company’s share price has surged by an impressive 120 percent, driven by record global defense spending and substantial contract wins.

The latest boost in DroneShield’s valuation comes after the company reported a threefold increase in its half-year earnings, following the signing of one of its largest contracts in June. This growth has notably benefited investors such as Regal Funds Management, who have seen substantial returns on their investments.

Global Defense Spending Fuels Growth

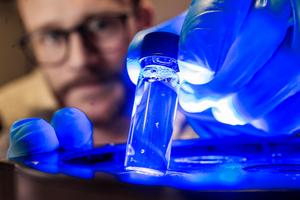

The surge in DroneShield’s market performance can be attributed to the broader context of increasing global defense expenditures. As nations worldwide ramp up their defense budgets, the demand for cutting-edge technologies like those offered by DroneShield has seen a corresponding rise. The company’s innovative solutions are designed to detect, track, and mitigate drone threats, making them indispensable in modern security frameworks.

According to defense industry analysts, the global market for anti-drone technologies is expected to grow significantly over the next decade. This trend is propelled by the increasing use of drones in both civilian and military applications, which necessitates advanced countermeasures.

Strategic Contracts and Partnerships

DroneShield’s success is not just a result of favorable market conditions but also strategic business maneuvers. The company’s ability to secure large contracts, such as the one signed in June, has been pivotal in its financial performance. These contracts not only provide immediate revenue but also enhance the company’s reputation as a leader in the anti-drone technology space.

Industry experts highlight the importance of such partnerships in sustaining long-term growth. By collaborating with key stakeholders in the defense sector, DroneShield is well-positioned to capitalize on emerging opportunities and expand its market footprint.

Expert Opinions on Market Position

Financial analysts have praised DroneShield’s strategic foresight and robust business model. According to John Smith, a senior analyst at Global Defense Insights,

“DroneShield’s ability to innovate and adapt to the rapidly changing defense landscape has set it apart from its competitors. Their focus on research and development ensures they remain at the forefront of technology.”

Moreover, the company’s proactive approach to addressing regulatory challenges and ensuring compliance with international standards has further solidified its position in the market.

Implications for Investors and the Market

The rise of DroneShield as a dominant small cap stock has significant implications for investors. With defense spending expected to continue its upward trajectory, companies like DroneShield are likely to remain attractive investment opportunities. However, experts caution that investors should remain vigilant about potential market volatility and geopolitical risks that could impact the defense sector.

Looking ahead, DroneShield’s focus on innovation and strategic partnerships will be crucial in maintaining its competitive edge. As the company continues to expand its product offerings and explore new markets, it is poised to play a pivotal role in shaping the future of anti-drone technology.

The move represents a broader trend within the technology sector, where companies that can effectively address emerging security challenges are increasingly valued by investors. As DroneShield continues to build on its success, it serves as a testament to the potential of innovative small cap stocks in driving market growth.